North America: Decisive innovation to fuel profit growth

HLB Survey of Business Leaders 2025North American leaders enter the new year with high confidence. 55% expect global growth to increase in 2025 compared to 43% of their global peers. Similarly, 91% are bullish about growing their business revenue in the next 12 months.

The US economy grew at 3.1% last year, surpassing tempered expectations, thanks to increased service sector activity. Canada's economy grew at a steady 2% through the year, with inflation anchored at 2%. Labor market performance remained strong in both countries, while domestic consumer spending grew at 3.7% and 1.9% respectively.

This year, however, growth may be more challenging. Cumulative risk scores are rising. Three-quarters are apprehensive of lingering economic uncertainty, caused by economic, regulatory, and political factors. Several tax cuts are expiring in 2025, including the Tax Cuts and Jobs Act from Donald Trump’s first term.

Although the administration is bullish about making changes in tax policies for both individuals and corporations. “From an economic standpoint, the domestic policies from a new administration are likely going to be positive for the economy and businesses,” says David Sternberg, HLB USA.

Businesses in Canada face significant economic and political uncertainty with the unpopular liberal government preparing for an autumn election, aggravated by the enforcement of the bilateral tariff. 73% of leaders north of the border are concerned with geopolitical risks (peaking post-US election) and trade flow disruption.

Despite a more challenging landscape, growth opportunities are out there. However, leaders will need to get more prudent with spending to protect profit margins and fund innovation. To accomplish this, leaders are focusing on improvements in three areas: operating model, workforce management, and innovation.

Operating model transformations

North American leaders are committed to making their businesses more agile, resource-light, and digitally enabled. To grow this year, 62% target operating efficiencies and 55% seek to cut costs and adopt new technologies.

Since the start of this decade, ultra-profitable companies have emerged that strategically leverage new technologies for revenue diversification and rapid market expansion. The technology sector naturally has some of the highest gross profit margins of 71.56% and so do investment services companies (73.27%) and biotechnology companies (72.1%) who combined strategic technology investments with fine-tuning in other operating areas.

Mastercard has built a scalable payment technology, bringing compounding returns as cashless transaction volumes skyrocketed.

By not overspending on scaling up, the payment company can maintain relatively low operating costs and strategically reinvest profits into consulting, marketing, and security services.

"Still, it’s important to remember why these companies are successful, to begin with,” says Giovanna Amantea, HLB Canada. “It is because they're always pushing the limits to be more efficient and more successful”.

Only 27% consider their operating model to be at optimum, while 70% rate it as such as needing improvement.

A good percentage of leaders are turning to artificial intelligence — the most important technology over the next five years — to harness operating model improvements. Practically, 79% of leaders seek to unlock greater analytical insights with AI. A Manufacturing CEO shared they're using AI to “track customer lead time requirements to better be able to utilize capacity for future projects”.

In a publicly listed Healthcare company, “AI is having an impact on supply chain prediction allowing us to streamline the number of suppliers and resources being used within the procurement phase. We are also seeing an impact on profitability in diagnostics costs”.

Refined people strategy

Promoting a productive and empowered workforce is the second profit imperative leaders are targeting. To grow this year, 47% plan to invest more in their people and 29% — address weaknesses in talent acquisition.

With fewer people in the talent pool, leaders are looking inward to cultivate missing capabilities. Half plan to improve their training and development programmes for continuous learning. With ongoing demographic shifts and massive technological changes, companies need to address skill mismatches between employees’ skills and the top competencies needed in their roles.

The transition to remote and hybrid work further aggravated the productivity issue, with employers questioning performance outside the office. This has culminated in a flurry of forced return to office mandates and rising levels of ‘productivity paranoia’ — with many businesses now deploying employee monitoring software to glean productivity metrics.

Emerging technologies can help unlock greater staff productivity. Half of the most profitable companies in our cohort are working to improve workflow and workload management and over 80% of them are deploying AI in this pursuit.

“Since AI adoption, we've been able to manage work schedules more efficiently which helps our employees tremendously and they become very productive. It's also helped us to predict our staffing needs and optimise staff deployment successfully,” shared a Technology company leader.

To retain their best workers and continue attracting high-calibre talent, leaders need to think holistically about the experiences they create. Workplace technologies can be a great conduit of innovation and process efficiencies.

However, obsession over the wrong metrics can cast the opposite effect, encouraging ‘productivity theatre’ over meaningful work. Respondents seem to recognise this as 47% plan to improve their company culture and purpose to ensure better support and empower their people.

AI-enabled, customer-centric innovation

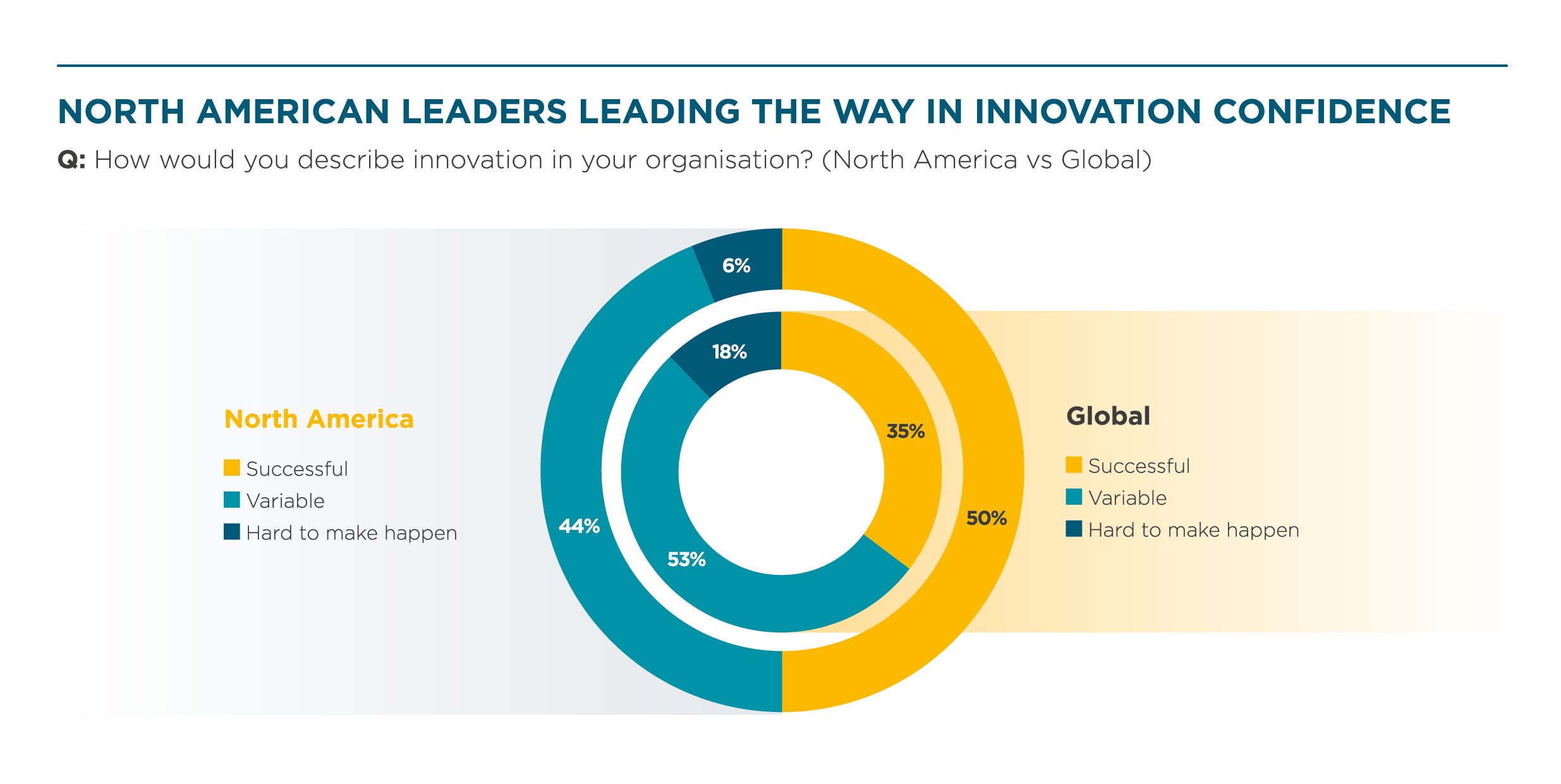

Half of regional leaders consider themselves successful innovators — the highest percentage globally. “Leaders are feeling successful at innovating because there is so much new technology coming into play at this point,” says Israel Tannenbaum, HLB USA.

AI and Cloud computing remain the most important technologies for business. Interest levels in machine learning, blockchain, battery storage and electrification have also grown compared to last year.

46% of regional leaders identify as AI Innovators — already widely using or eager to deploy the technology in their business. However, a quarter of leaders are in the opposite camp — concerned about the AI risks or doubtful of the technology’s impacts.

Among those using AI, investment choices have become more strategic and narrowly focused on achieving operational improvements. Top AI use cases include customer analytics (44%), process automation (41%), content generation (37%), and employee training and development (35%).

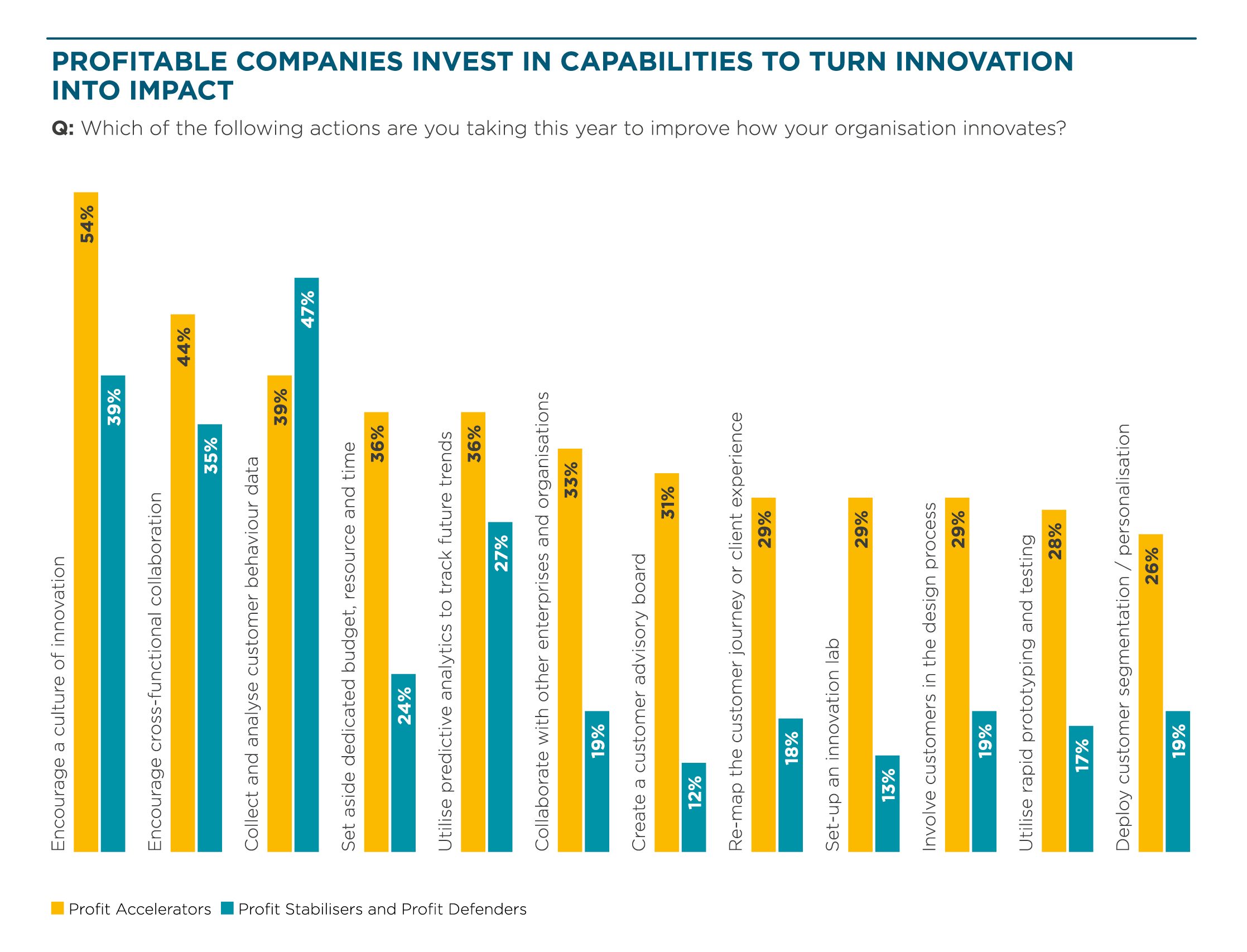

Beyond new technology adoption, 43% of leaders are also taking two other important steps to improve how they innovate — encouraging a culture of innovation and analysing customer behaviour data.

It appears that some businesses in the region see AI as a conduit for building a more customer-centric operating model: instead of launching products hoping to find a market, they are working with customers to orchestrate growth. Among those focused on improving their innovation capabilities, an impressive 81% use predictive analytics to track future trends.

When building out its award-winning electronic trading platform Aiden, the Royal Bank of Canada (RBC) adopted a customer-first approach to development. After launching the first interaction of the reinforcement learning algorithm for volume-weighted average price trading, the team sought customer feedback for subsequent product development. Listening to their audience, they prioritise the next R&D use case — liquidity-seeking — which is then implemented in the next algorithm generation. By proving the demand first, RBC avoided sinking resources into costly algorithm development.

Among the most profitable companies in our survey, 36% plan to set aside time, resources, and a dedicated budget for innovation this year, versus 24% of companies whose profit margins remained stable or decreased.

Similarly, the most profitable companies are more committed to breaking down organisational barriers with 44% placing a greater emphasis on cross-functional collaboration to improve innovation.

In other words: They not only track the market pulse and capture customer feedback but also take proactive steps to improve their internal innovation capabilities through investments in people and processes.

An impressive 28% of the leaders in North America are ‘Profit Accelerators’ — companies whose profit margin increased by 5% or more this past year. Discover the strategic secrets behind maximising profit margins; download our in-depth report

Related content

Learn more about our research