Seeking talent and efficiency

European priorities for navigating the storm - HLB Survey of Business Leaders 2023Having just entered the recovery phase, European business leaders face yet another crisis: Russian aggression against Ukraine and the subsequent market turmoil it has triggered — soaring energy costs, rising geopolitical tensions, and once-again disrupted supply chains.

Continued disruption over the past twelve months means European leaders remain wary about the future prospects. 69% believe that global growth will decline this year, compared to 53% of the global HLB survey respondents. Likewise, only 68% of European leaders are very or somewhat confident in their company’s ability to increase revenue this year, compared to 79% globally. The pessimism runs deep as 28% expect a decline in their company’s revenue this year.

The muted economic growth sentiment also prevailed in the Autumn 2022 Economic Forecast by the European Commission, suggesting a 0.3% decline in GDP growth and a persisting inflation rate of 8.5% in the euro area, home to the majority of respondents in our sample.

However, more recent data in the EU’s Winter 2023 Economic Forecast supports greater optimism. The projected growth outlook for this year rose to 0.8% in the EU and 0.9% in the euro area. The wholesale gas prices have already fallen well below pre-war levels. Furthermore, the EU labour market has performed well, with the unemployment rate remaining at 6.1%, a record low.

Leaders themselves have shown exceptional abilities to navigate a protracted storm — first, the pandemic, now — the ongoing and inter-related geo-political and economic challenges. Now they must regain a stronger footing by pursuing leaner operational practices and new leadership strategies to successfully navigate choppy waters.

New risks on the radar

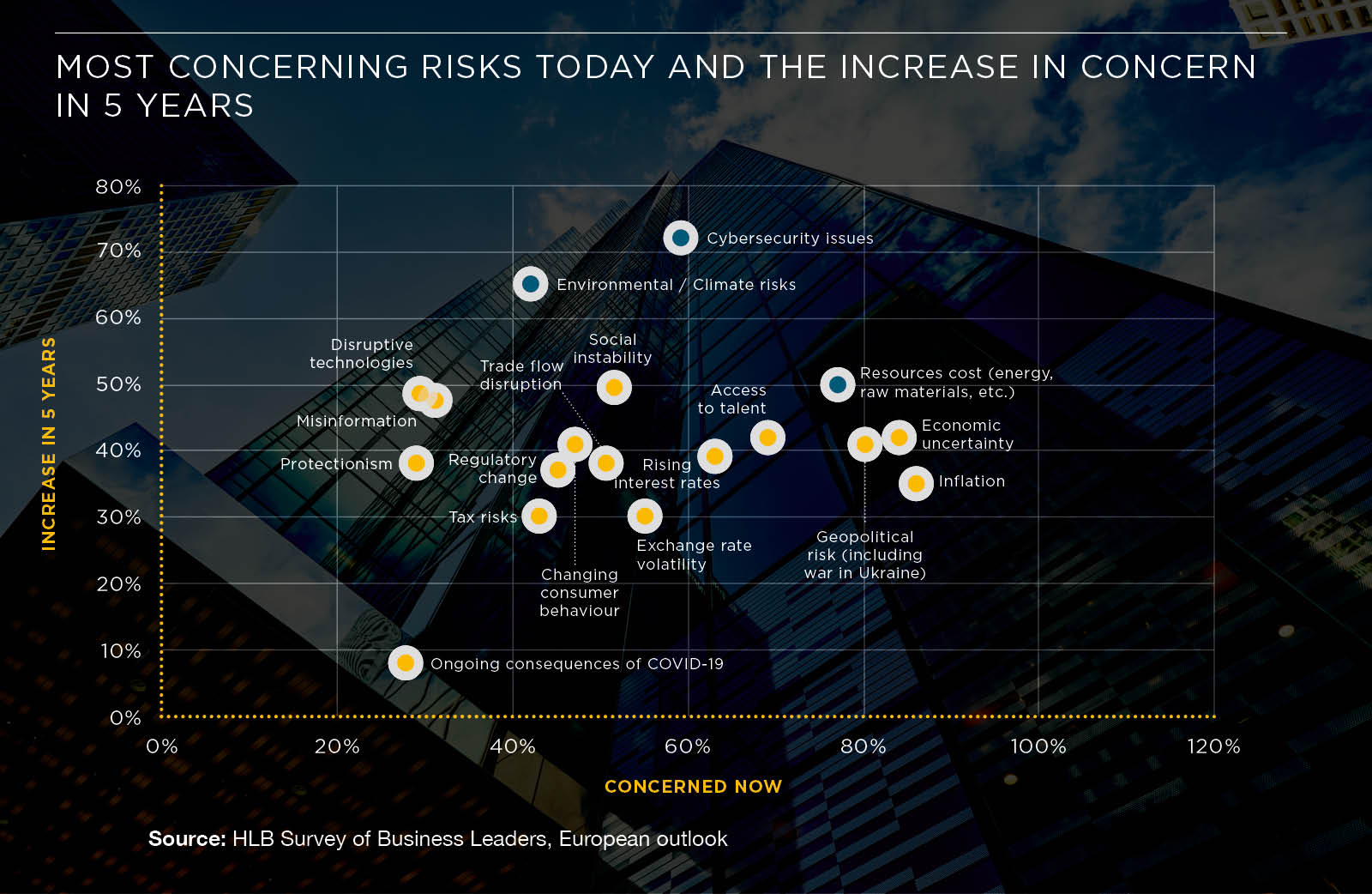

European leaders continue to face strong headwinds with new and intensifying risks to growth. Compared to global respondents, Europeans are more concerned about resource costs (36% vs 30% globally are very concerned about rising energy and materials costs) and geopolitical risks (31% vs 26%). Both of these risks emerged over the past twelve months, compounding supply chain disruption and economic uncertainty caused by the pandemic.

European business leaders also fear the impacts of inflation (85% vs 82% globally), and economic uncertainty (84% vs 78% globally) more acutely. Factors like “access to talent”, “rising interest rates”, “exchange rate volatility”, and “cybersecurity issues” are also top-of-mind for over half of the respondents.

In the five-year perspective, leaders in Europe expect some of these risks to become more arduous. Cybersecurity risks are expected to become more prominent by 74% of European leaders, followed by climate risks (57%) and social instability (48%). Whilst they expect resources cost, inflation, access to talent, and economic uncertainty to remain lingering concerns.

Interestingly, Europeans are more anxious about the future impacts of “disruptive technologies'' (48%) and “misinformation” (46%). Perhaps European leaders feel they haven't done enough to keep up with competitors in the US and China regarding tech-driven innovations.

Misinformation, made easier by social media, is a pressing problem. Europeans come across fake news (that falsifies or misrepresents reality) on a daily basis. The ongoing prevalence of misinformation, combined with undue political influence, lowers public trust in media. A Digital News Report by Reuters found that over half of Western Europeans don't trust the news. In Italy, for instance, only 35% believe the credibility of their news agencies’ most of the time.

Lack of trust in public institutions and the media is leading to polarisation in society. As living costs rise and political disagreements continue, concerns around social instability are likely to increase.

That said, European leaders appear steadfast in the face of such disruption. When asked about the main focus of their business over the next 12 months, respondents are more committed to transformation, over survival. 88% are focused on business transformation, with 35% making it their sole focus and 53% balancing transformation with survival-driven activities.

Endurance and growth are somewhat conflicting priorities, which require a great degree of flexibility and operational tenacity. European leaders are making the most of their ‘cash cows’, in contracting market segments, and investing in initiatives to drive future growth. In the words of a senior executive in the real estate & construction industry, leaders must “remain flexible to change organically and keep an eye on costs and invoices”. That’s a tough balancing act.

Key priorities for European leaders: Talent management and higher operational efficiencies

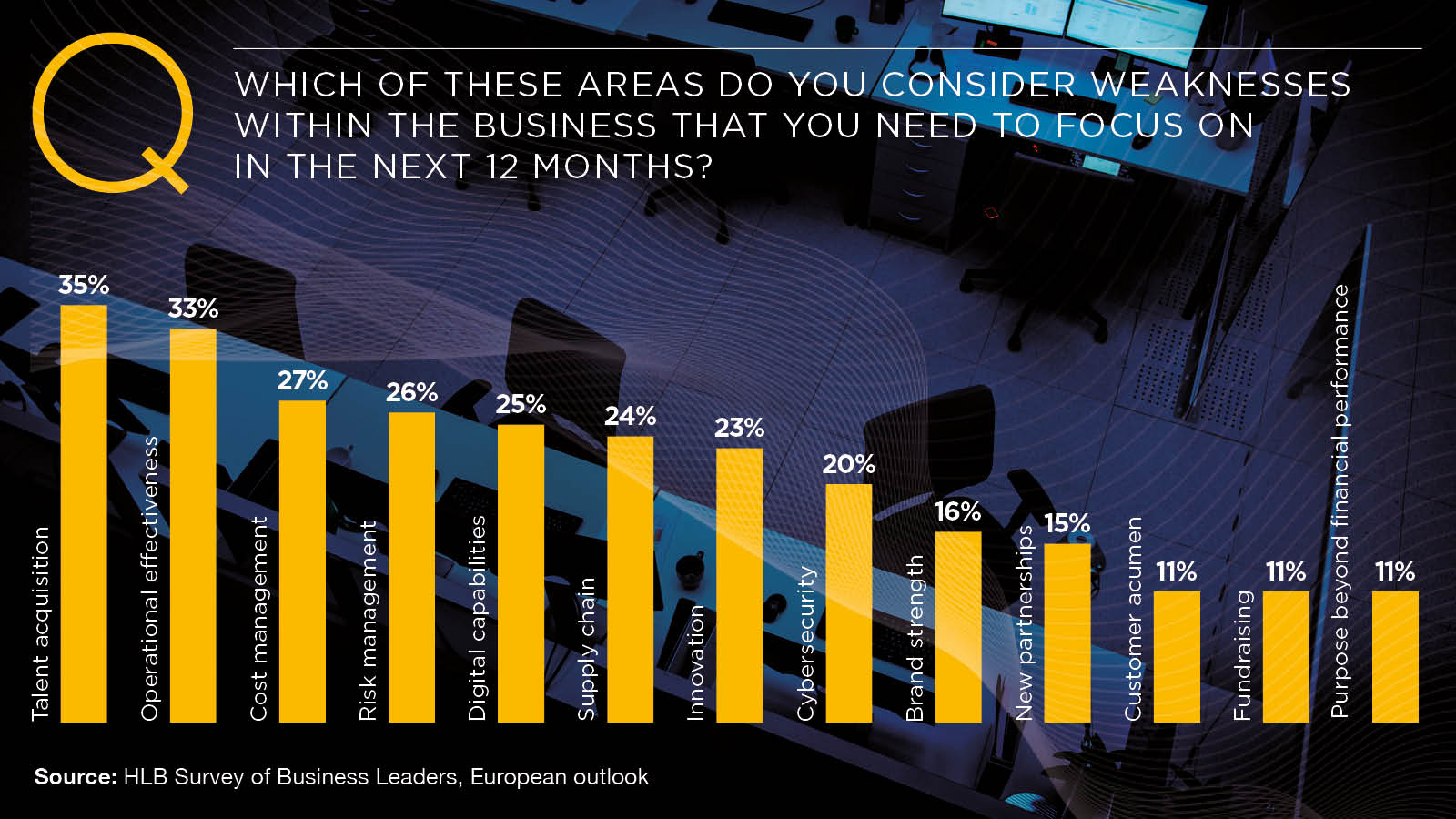

European leaders are looking to strengthen multiple anchors to steady them through stormy conditions including weak spots in talent acquisition, operational effectiveness, and supply chain management. Hiring new talent and improving operational efficiencies are also amongst the top actions leaders plan to take this year in order to grow and remain profitable.

The talent factor

Having a competent crew is just as important as an experienced captain and the type of vessel you’re operating. Yet, good talent is hard to find. The European markets continue to face labour shortages. Over half of the German companies struggle to find skilled labour. The UK faces a shortfall of over 330,000 workers, with sectors like transport, warehousing, retail, and healthcare among others feeling the biggest impacts.

In our 2022 survey of European leaders, 40% were determined to focus on weaknesses in talent acquisition. In 2023, the cohort who see talent acquisition as problematic is now 48%.

More importantly, leaders aren’t just short of staff. They can’t source workers with the right skills to deliver results effectively and efficiently, and at speed. To cope, over half plan to evolve their human resource model to meet the future requirements of work.

Also, 76% are focusing on improving workforce productivity including 56% who are doing so in combination with accelerating the adoption of digital technologies. This alternative focus area will likely help to drive efficiency gains as well as helping to facilitate business model transformation and new product development. Over the next five years, European leaders see the following digital technologies as most important to their businesses — cloud computing (48%), AI (45%), and machine learning (33%). In the words of a CISO in the tech sector, leaders need to “obtain comprehensive knowledge to understand the transformations that will be necessary for the short term for good professional performance”.

Finding the right people

Power in Europe’s labour market is currently with candidates. Professionals recognise the demand for their capabilities and can be more selective with job offers. Post-pandemic, many expect flexibility in employment, preferring remote or hybrid working. Not all employers have embraced the ‘digital workplace’, however.

At the same time, the Great Resignation continues according to Leapsome’s global survey, with 86% of professionals (mostly in IT and tech industries) planning to resign in the next 12 months. The prospects of better pay and the work-life balance primarily drive the decision to quit, although other factors are also at play.

Younger generations entering the workforce are looking for more meaning in their work. Uninspiring leadership, disingenuous corporate social responsibility (CSR) programmes, and an inability to connect with the corporate purpose all contribute to resignations.

Purpose can be a favourable factor for retention. When employees feel connected to your mission and feel that they’re doing useful work, both for the business and society at large, they’re less likely to leave.

Among our European business leader respondents, 67% have identified the purpose of their business, which might vary from profit to community-focused. A slim majority of European leaders (55%) are focusing on improving environmental, social, and governance (ESG) impacts, including 11% who suggest this is their sole focus versus a significant number (45%) who are focusing solely on improving business performance (45%) in 2023.

ESG is perhaps regarded as a “luxury” in these challenging times — an additional investment with unclear returns. Perhaps why many treat ESG as a check-box activity. 56% of respondents either disregard it altogether or do only what’s required by regulators. Only 9% of business leaders in Europe identify with being ‘purpose-led’ vs 15% globally.

Yet, there are tangible longer-term benefits to improving CSR practices and ESG factors. Findings from across Europe suggest that the environmental dimension of CSR improves innovative potential, reduces operating costs, and provides a competitive advantage. Investments in ESG areas can contribute to innovation capacity and performance via greater material support from stakeholders and governments, and the creation of new workplace models. A refreshed way of working is more conducive to innovation and improves corporate reputation, which, in turn, can attract better talent and improve motivation, morale, and loyalty.

“Stay focussed, stay human, and create value for money” says a CEO in the Business Services industry.

Seeking operational efficiencies

Despite the muted economic outlook, 88% of business leaders in Europe remain focused on pursuing long-term priorities to thrive, with 48% also combining them with short-term survival activities. A much smaller group is focusing solely on immediate survival.

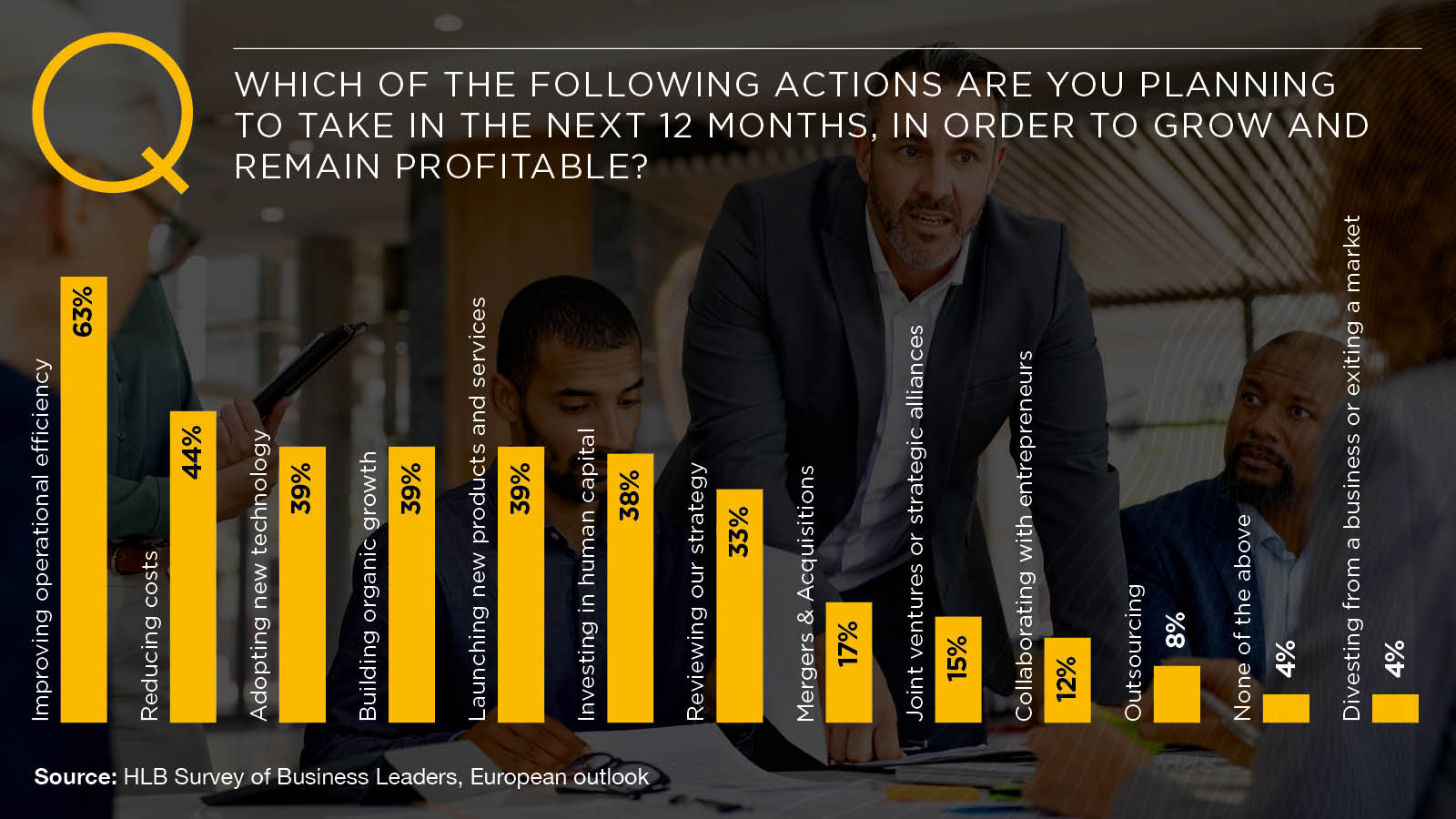

When asked to choose between improving operational efficiencies versus investing to innovate and grow, 78% are focused on operational efficiencies, although the majority of these are aiming to tackle both, simultaneously. But is doing both feasible?

In last year’s HLB survey, 86% of European leaders expressed greater confidence in their ability to innovate than in pre-pandemic and doing so at faster speeds than in the past. However, the majority also selected “lack of time” and “insufficient funding” as the key barriers to innovation. This year, leaders have even less time or investment capacity to innovate due to the disruption caused by rising energy costs, inflation, interest rates, and geopolitical tensions.

At the same time, many face workforce constraints, as cited earlier. Understaffed teams are now asked to achieve more in less time and on a smaller budget. 76% of leaders based in Europe (Q4) plan to increase headcount to improve productivity, however, the majority of these (47%) are, at the same time, cutting staff in other areas to save costs. Workforce optimisation is a natural ‘coping mechanism’. When immediate growth isn’t an option, cost cutting and efficiency improvements become necessary priorities. For 64% (Q2) improvements in operational efficiency performance are the key priority for 2023, followed by cost reduction (43%) and new technology adoption (40%). That said, leaders can only cut costs once. To thrive in the longer term, they will need to consider a broader range of operational changes.

Revving up the engine for growth

Given the market conditions, it’s not surprising that Europeans remain cautious in the short-term, but more optimistic on their future outlook. 88% are focused on both transformation and survival. As a leader in the agriculture sector commented, “this [crisis] will pass, make good choices in the interim. Fix and lock things down to determine operational performance, do not speculate.” So how can European leaders operate at faster speeds and at a lower cost?

Eurostat 10 suggests that the real labour productivity per hour worked figure has been continuously increasing over the past five years, even through 2020-2021. The EU also benefits from having a relatively high percentage of the population with a post-secondary degree. Despite these factors, Europe appears to lag behind in terms of high-tech innovation.

In 2020, European companies curtailed spending on research & development (R&D) projects — and so did regional investors. Even prior to the pandemic, many leaders were treading carefully with investments in information and communication technologies (ICT). As a result, European companies now trail behind the US and China in terms of R&D growth rates, according to the EU Industrial R&D Investment Scoreboard 11 in sectors such as ICT products, healthcare, and ICT services.

Interestingly, European business leaders are more focused on building organic growth than their global peers who are more likely to be launching new products and services. With less capacity for innovation activities in 2023, they appear to be pinning their hopes on maximising the value of their current product/services portfolios. Yet, as a European CEO in real estate and construction noted: “New opportunities are born from a crisis. Look forward and be prepared to supply what will be needed in the near and further future. Don't become the Nokia within your business.”

Supply chain and sustainability

Supply chain was selected as the third area which will require bolstering in 2023. The majority plan to fix ongoing challenges by simultaneously applying ‘lean’ and ‘just-in-time’ principles and creating surpluses where needed.

Since “rising resource costs” is an acute risk for businesses today and one which they expect to rise over the next five years, this is a sound strategy. Logistical issues have placed regional supply chains under significant stress since the start of the decade. Bottlenecks in container shipments, lockdowns in Asia, and port congestion lingered for months throughout 2020-21. Early signs of stabilisation in 2022 soon vanished on renewed geopolitical tensions.

Energy security has been disrupted in the region and European countries have had to rapidly find new energy supply routes to adapt to rising oil, gas, and electricity prices. High energy costs have prompted some businesses in Europe to reduce their operations, which has further strained supply chains.

These factors remain ongoing concerns, but they may also prompt leaders to reconsider earlier practices and move towards more sustainable sourcing and operating strategies. It is not surprising that renewable energy features in the top three technologies most important for European businesses over the next five years.

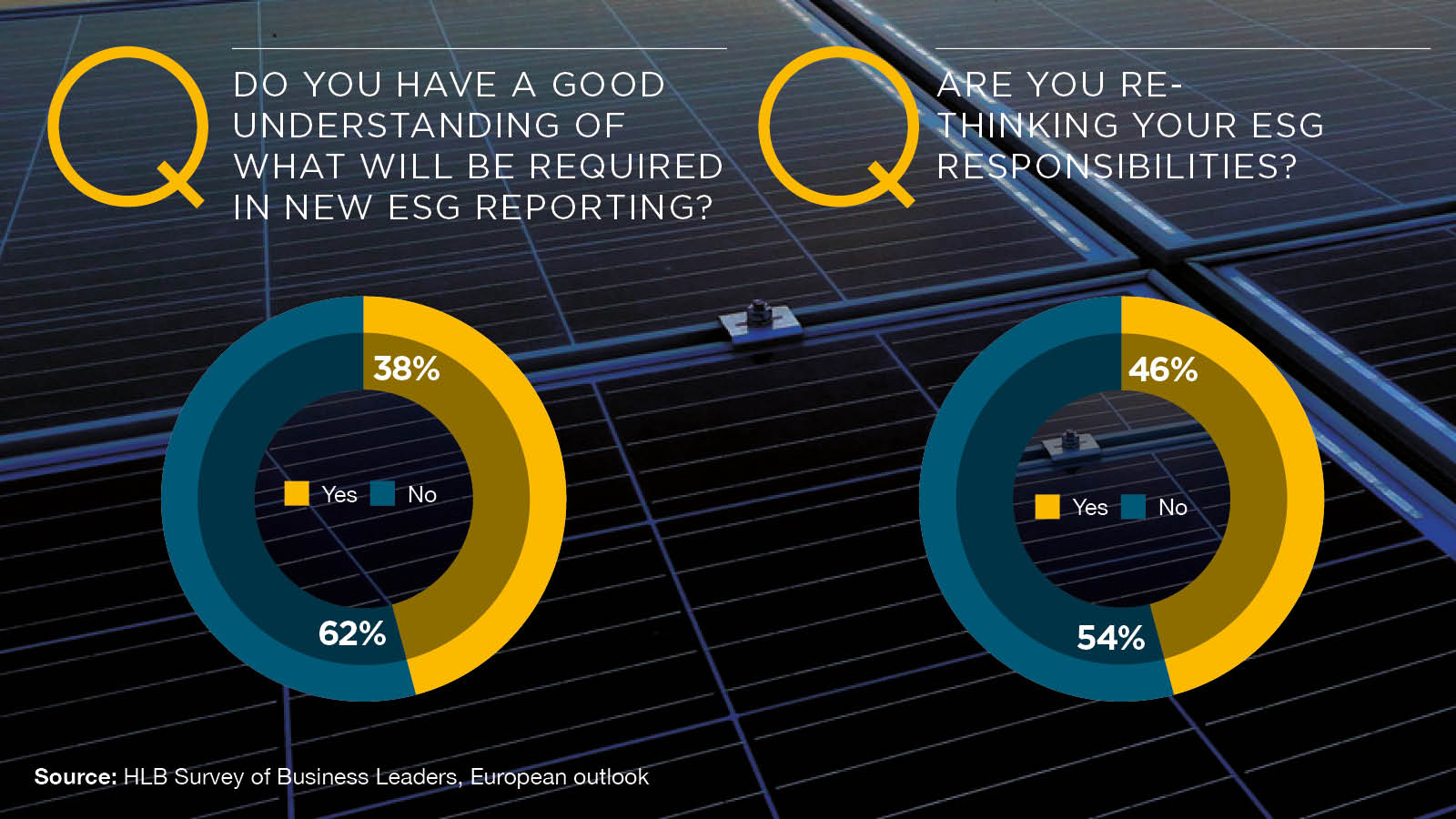

The importance of sustainability has increased in the aftermath of the War in Ukraine, the impacts of climate change and other incidents seen globally. Many businesses are already making important choices in response to societal concerns, such as safeguarding workers in dangerous location or changing their operations in Russia. However, less than half (46%) plan to rethink the broader ESG responsibilities and more than half (54%) don’t consider ESG as a priority for 2023, in contrast with stronger intentions around ESG shown by their global peers. This may be an oversight as in the words of one of our survey respondents: “The impending regulation that will come our way means we need to think about and act on it sooner rather than later.”

Reluctance to act on ESG may be explained by a limited understanding of ESG and potential future reporting requirements. Only 38% of European leaders have a good understanding of what will be required - and more importantly, how ESG can be deployed to enhance competitive positioning (from the supply chain to talent acquisition and customer consideration).

Strong ESG performance also opens access to new capital in the form of government subsidies, tax rebates, and investment schemes. Green taxation initiatives are underway at both the EU and Member State levels. The European Investment Fund (EIF) plans to allocate 50% of its financing to companies, pursuing climate-related initiatives.

At the same time, ESG disclosures are becoming mandatory. The Corporate Sustainability Reporting Directive (“CSRD”), approved at the end of 2022, will require publicly listed and enterprise-sized companies to report information on risks and opportunities arising from ESG issues, starting in 2024. The reporting requirement will extend to smaller companies over the following four years. From 2028, CSRD will also reply to non-EU parent companies, which have at least one EU subsidiary and generate over €150 million in net turnover in the region.

A number of other ESG reporting frameworks have emerged. Sustainable Finance Disclosure Regulation (SFDR) requires financiers and asset managers to make investment decisions based on ESG factors and provide wider product-level disclosures for goods labelled as ‘sustainable’.

The Regulation on the EU Climate Transition Benchmarks also establishes two new tools investors can use to assess future investment decisions in Europe — the EU Climate Transition Benchmark (EU CTB) and the EU Paris-Aligned Benchmark (EU PAB). Individual companies can also follow guidelines on non-financial reporting to report on generated carbon footprints and greenhouse gas emission levels.

ESG reporting frameworks offer an opportunity to benchmark your business against regulatory targets and locate underperforming areas. Improvements in these can give your company a competitive advantage in terms of greater investor, shareholder, and customer support. HLB advisors would welcome discussion on ESG reporting and opportunities, generated by sustainability-led actions.

How other leaders are re-thinking ESG responsibilities

ESG is an undeniably complex subject. Each component — environment, social, and governance — includes multiple sublayers of best practice guidelines. As part of our survey, we asked what ESG actions European leaders take to meet wider stakeholder expectations. Below are some of the strategies they plan to pursue this year.

CEO in a Financial Services industry:

- Building a sustainable world, by reducing our own ecological footprint with concrete actions (housing, renewable energy, reducing consumption, recovering rainwater, etc.);

- Solidarity for a more humane life;

- Commit to supporting local investments;

- Environmentally conscious mobility;

- Favour quality education;

- Employee welfare.

Italian CEO in the Hospitality & Leisure

“Attention to governance aspects, paying attention to the expectations of Personnel, the adoption of the legality model L. 231, the adoption of extremely clear contractual relationships with Suppliers.

Under the social profile, we will create, in a new location to which we will move, an area that will be dedicated to encouraging discussion and development of ideas by Researchers, Start-ups, and Undergraduates.

Environmentally, we will equip the new headquarters with natural energy generation facilities and install charging stations for electric cars in our parking lots, which can also be used by third parties." [translated]

German CFO in the Transportation & Logistics

“Preparation of ESG/CSR reports, the appointment of sustainability officers, compliance with supply chain due diligence requirements”. [translation]

Executive in the Agriculture Sector

“We are working in Vertical Farming and with growers. A lot of what we do is around food security, food sustainability and fewer food miles. As we evolve we need to also get closer to Net Zero and look at alternative sources of power”.

Strong leadership is required for the times of crises

Leading through the storm isn’t easy. With the high degree of uncertainty, few leaders can produce accurate “readings” of the current markets. Previous best practices lose their potency and companies must continuously reinvent themselves to meet the new risks and navigate around constraints in revenue growth.

No wonder “flexibility” emerges as the most important quality for successful leadership in times of crisis. “Willingness to change and adapt to the environment is key to personal growth and success,” one a leader from the business services sector further elaborates. Whilst a CFO from the Manufacturing sector also notes that leaders shouldn’t be “afraid to make mistakes but learn from them and move on.”

Leaders who can respond flexibly to new challenges will succeed. However, they must also act with integrity, rather than look for shortcuts to success. Honesty and empathy are important to make customers trust you, trust is uttermost important,” a CEO in the Retail industry says. European leaders must rally support from employees, customers and wider stakeholders to maintain a positive brand reputation, essential for long-term success.

“Do not let yourself be ruffled”, a CISO from the tech industry says. Every storm eventually passes, but while it rages you have to maintain a strong posture to reassure the people around you. Compelling communication was the third top essential behaviour European leaders selected. Maintaining a positive public image during turbulent times when societies are polarised and dealing with constant misinformation requires timely, candid, and open communication both with your people, customers, and broader society. “Motivation, courage, endurance, and innovation” are the qualities that will help you survive and thrive in the challenging business environment, according to a financial services leader.

Sector outlooks

Learn more about our research