Mexico: A strategic hub for nearshoring and foreign direct investment

HLB FDI Insights

Over the past two decades, Mexico's economic growth has lagged behind that of regional peers such as Brazil and Argentina. This slower pace can be attributed to the implementation of macroeconomic policies prioritising stability.

Measures such as inflation control, which have constrained private investment and household consumption, and efforts to balance public accounts, a long-standing structural challenge, have weighed on growth. For 2024, the economy is projected to grow by 2.3%.

Political developments under the current administration, particularly proposed constitutional reforms, are adding uncertainty to the country’s economic trajectory. Key concerns include potential market volatility arising from judicial appointments and efforts to limit the judiciary's power to influence presidential reforms.

This climate of political and policy uncertainty poses risks to long-term investments in Mexico, underscoring the importance of fostering a stable and predictable business environment to support sustained economic growth.

Summary of the country

Nearshoring is the name of the game for Mexico when focusing on inflows of foreign direct investment, especially those coming from the United States, but not only from it (countries like Brazil and China are investing in Mexico as a way to take advantage of the commercial relationship with the United States).

Nearshoring started to make perfect sense due to the combination of several factors:

- Rising labour costs in China.

- Disruptions to global supply chains caused by the Covid-19 pandemic.

- Geopolitical tensions between China and the United States.

- The USMCA agreement, which modernised and replaced NAFTA.

If the reallocation of investments and supply chains has changed the logic from offshoring to nearshoring, and if Mexico is very well positioned due to its geographic proximity to the United States, doubts remain as to whether the country will be able to offer the business environment necessary to attract the full potential of resources from abroad.

Data presented by the Secretariat of Economy in a recent report illustrate this challenge. In the first six months of 2024, the country registered a record US$31 billion in foreign direct investment, however, of this total, only US$909 million are new investments, the rest represent reinvestments of earnings in the country.

Key trends

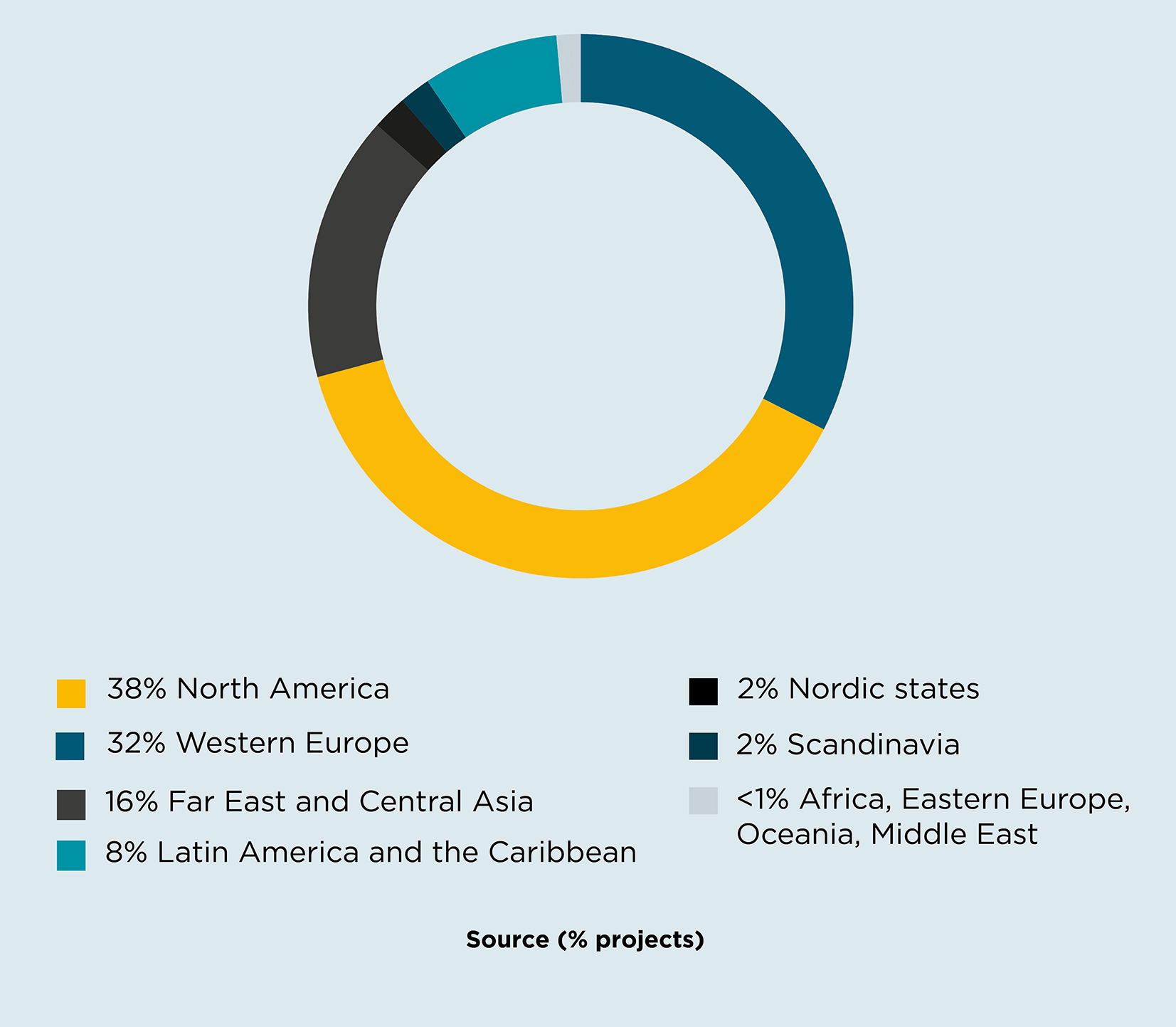

The United States is the leader in foreign direct investment, though Germany, Japan and Canada have also increased their investment in the country.

The Manufacturing sector has the largest number of projects, highlighting:

- Transport equipment

- Beverages and tobacco

- Chemical industry

Mexico City is the main investment destination, followed by Nueva León, Baja California and Estado de México.

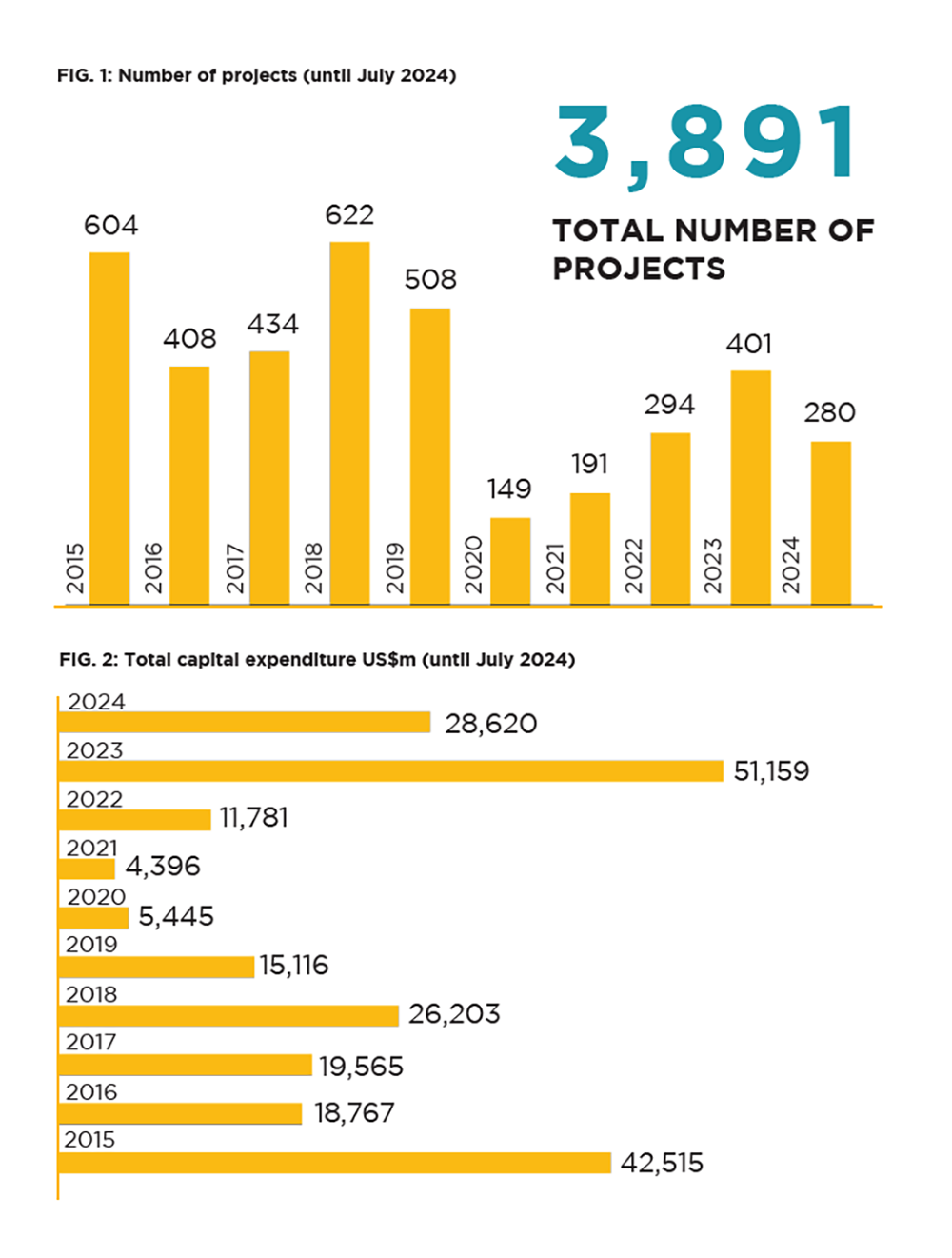

For the purpose of this report, only announced and already executed projects were considered (also were not considered reinvestment of profits earned in operations abroad and intercompany loans).

Source of data: Orbis Crossborder Investment

To read the full analysis on investments and the economic outlook in Mexico, download our FDI report.