AI

adoption in the Middle East and Africa

HLB Survey of Business Leaders 2024Strong regional economic growth shapes a positive outlook

Business leaders’ confidence in the Middle East and Africa is on the rise: 90% are confident in their ability to grow revenue this year. Of these, 47% are very confident — a twofold increase from 2021.

In 2024, Africa is expected to become the world’s second-fastest economic region after APAC, with an estimated real GDP growth of 3.2%. East Africa, in particular, is to show strong performance, thanks to expanding travel, hospitality, financial, and telecommunications industries.

Fifteen African countries posted output expansions of more than 5% last year, and the continent accounts for eleven of the world’s 20 fastest growing economies, according to the African Development Bank Group. The Middle East and North Africa (MENA) region is also projected to show a strong 2.7% GDP growth rate in 2024 due to loosening OPEC oil production quotas and strengthening trade ties in Asia.

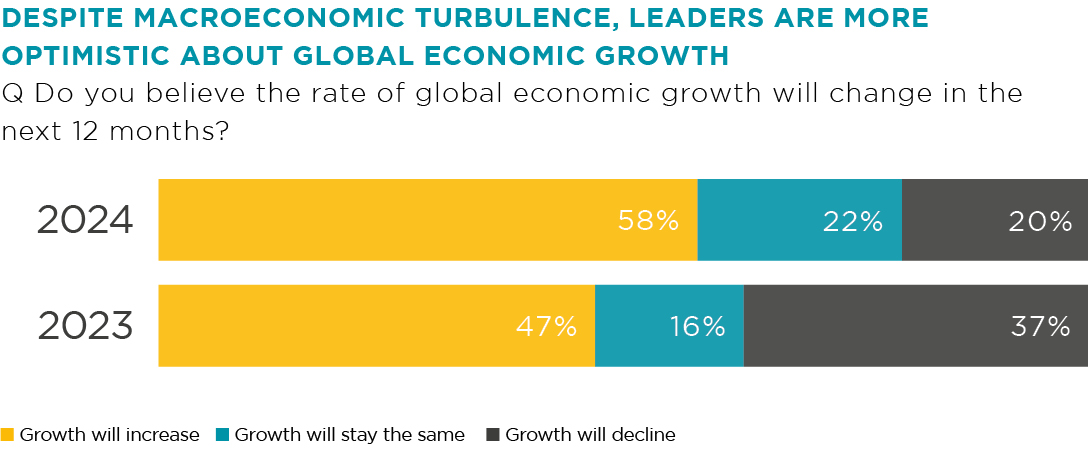

This has driven economic expansion in the Gulf Cooperation Council (GCC) states, with an increase in consumer spending and a relatively low inflation rate of 1.3% and 2.8%. Countries outside the GCC are facing higher macroeconomic imbalances and inflationary pressures. Nonetheless, business leaders maintain a positive outlook: 58% expect an increase in global economic growth, up 11% from 2023. Moreover, 17% fewer leaders expect a decline.

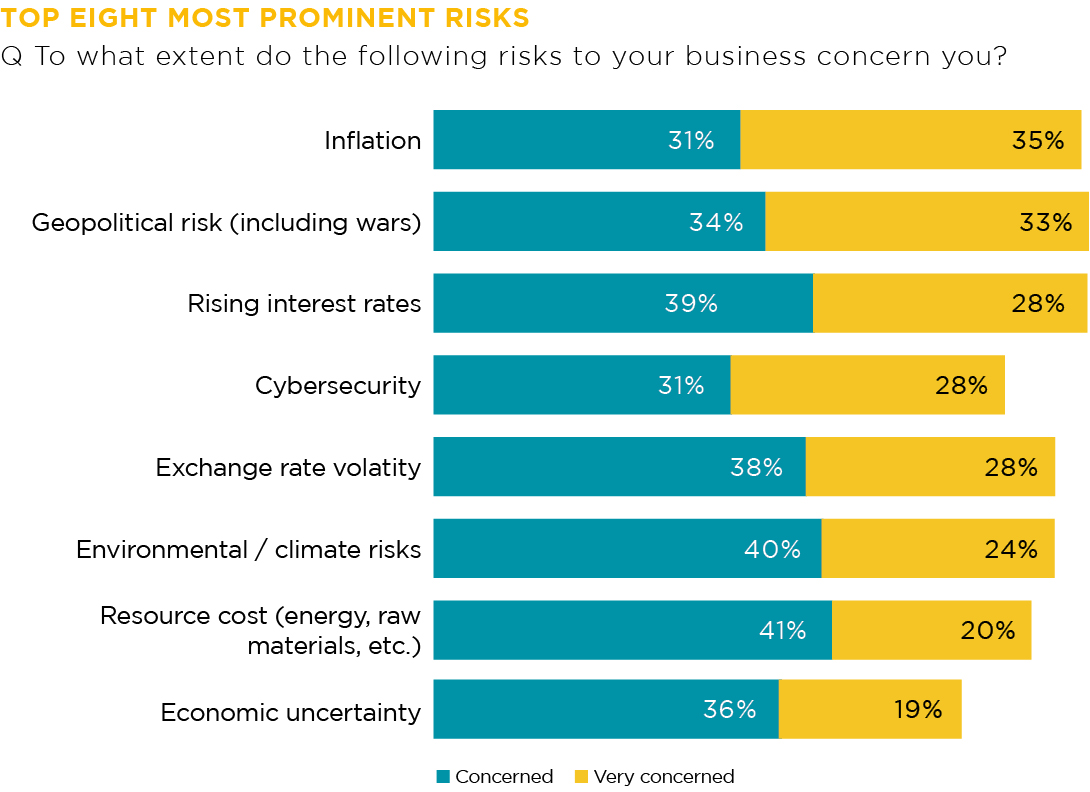

While improving macroeconomic conditions inspire optimism, local operators also face greater risks. Over 50% of leaders are pressed by 13 different risk factors — the largest risk radar globally. Geopolitical risks (67%), rising

interest rates (67%), and inflation (66%) are top-of-mind concerns.

Focus for 2024: Efficiency, technology and revised strategy

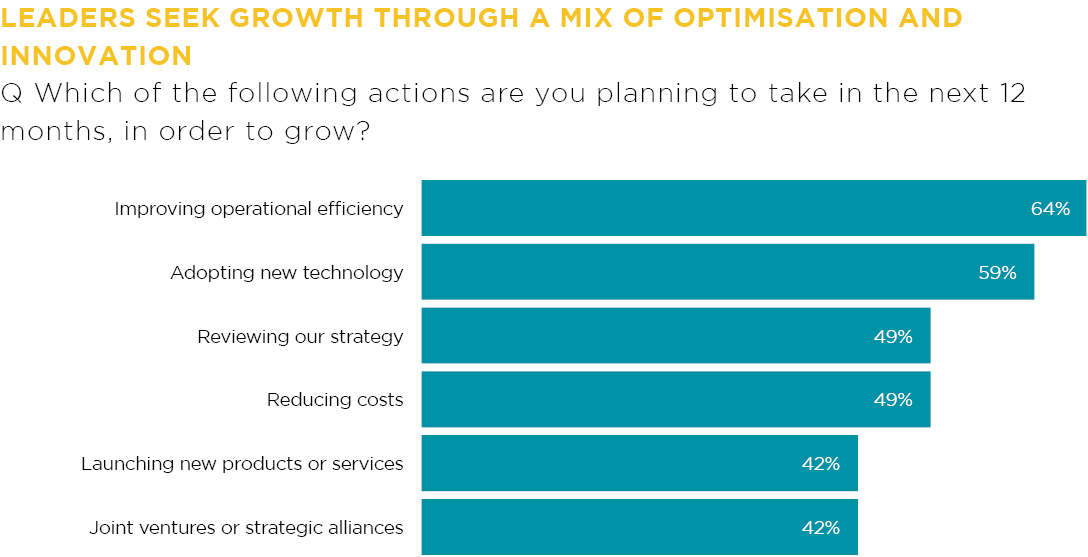

Last year, 84% of African and Middle East leaders focused on investing in innovation and growth, with more than half aiming for improving operational efficiency at the same time. The trend continues, with 64% marking ‘increasing operating efficiency’ as the top priority for growth, alongside ‘new technology adoption’, selected by 59%.

The African continent also has burgeoning digital economic sectors, thriving thanks to improved Internet penetration and greater adoption of mobile money solutions and FinTech products. Ecommerce penetration in Kenya increased to 16%, the third highest rate in Africa after Mauritius (22%) and Tunisia (25%). Kenyan officials seek to further

accelerate adoption through a national ecommerce strategy published in December 2023.

Maghreb countries continue to strengthen their positions as nearshoring IT and business services suppliers. The ICT sector in Morocco generates between 5% and 6% of the country’s GDP. Tunisia’s ICT service exports reached $431 million in 2022, an almost two-fold increase from 2020.

Amidst burgeoning digital enterprise, almost half of business leaders plan to initiate strategy reviews this year. New product or service launches are also a priority for 42%, although the interest is more tamed compared to 2020, when 56% were prioritising this action.

Instead, a higher percentage of leaders this year are in a ‘saving mode’. 49% plan to reduce costs, up by 6% from 2023. 29% also flagged ‘cost management’ as a weakness to address. Although, it appears that cuts won’t affect tech budgets.

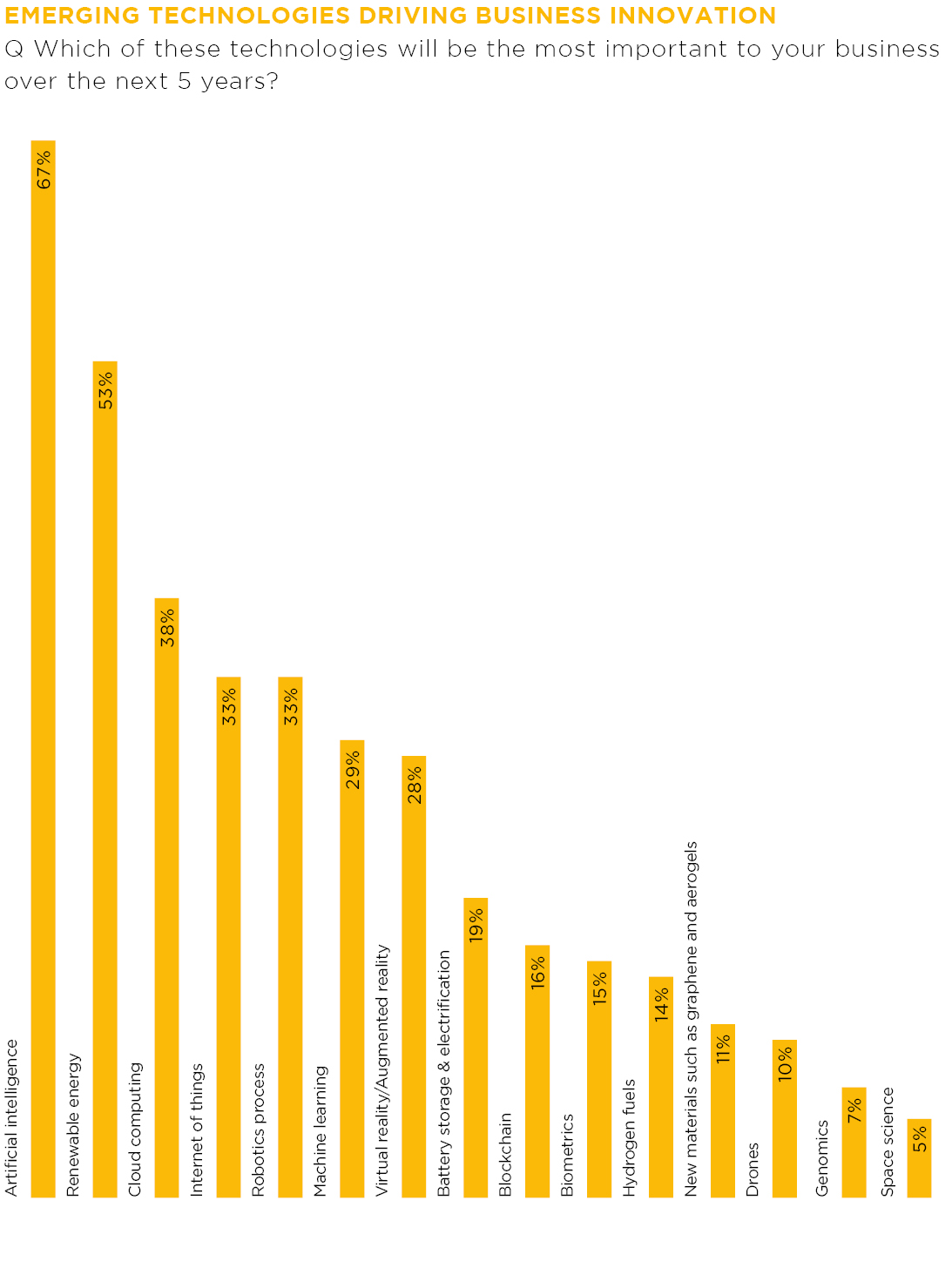

On the contrary, the adoption of new technologies is now a priority for 59% of leaders, up 26% compared to 2022. By a long shot, AI overshadows all other emerging technologies: 67% ranked it as the most important technology for the next five years, with interest levels doubling since 2020.

Rising levels of AI maturity

The majority of Middle Eastern and African leaders are AI Innovators: 47% are already either widely using or eager to adopt AI to build a competitive advantage. “[We’re seeking] digital transformation allowing integrating full processes into measurable outcomes mainly addressing a drop in human interference and a growth in saving on time,” a CEO from the Media & Entertainment industry said.

33% of leaders identify as AI Explorers, willing to try AI for the right business case or a convincing cause. A CEO from the Business Services sector mentioned that they’d like to have a “complete understanding as to how AI can help my business to grow or even benefit” prior to investing. The region also has a good degree of AI Conservatives: 19% express caution and are doubtful of the impact.

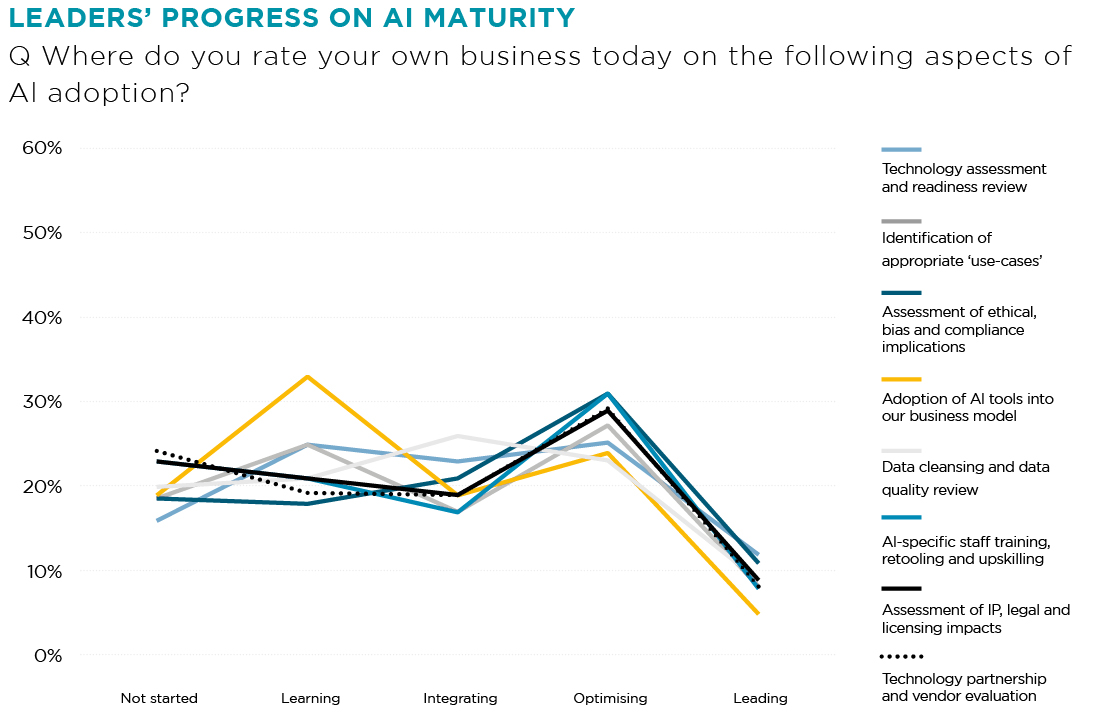

All business leaders in the region, regardless of where they are on the maturity curve, are making steady progress in AI adoption. 60% performed tech assessments and readiness reviews, with 12% leading in this area. However, less progress has been made in other areas: 52% haven’t yet adopted any AI tools in the business model, and 44% haven’t yet completed AI-specific staff training.

Over 50% of AI Explorers have yet to start or are just learning about appropriate use cases, technology assessments, data cleansing, and reviews. 46% haven’t looked into possible technology partnerships, and 41% haven’t started assessments of legal, IP, and licensing impacts.

Governments in the region can set an example of responsible AI implementation and usage by piloting policymaking through select proof-of-concept projects. Such trials can also serve as case studies for business leaders and the general public, reducing fears and misinformation. Survey respondents mentioned “information regarding the operations and tasks performed by AI “ and “more learning and case studies” as factors that would help them on their AI journey.

Learn more about our research