Foreign direct investments in Brazil and the FinTechs revolution

By Marcelo Fonseca, Global FDI Leader

Brazil has the largest economy in south America, and with a population of around 210 MM people this country represents a huge consumer market. Although inequality is a major problem, the potential market of Brazil is unarguable.

No differently from other countries, COVID-19 hit the Brazilian economy hard. Central government implemented several programs to support workers and businesses, and in response, fiscal deficit rose substantially. Fiscal measures seemed to be efficient at first, however, the second wave of the pandemic is again pressuring the weak situation of the fiscal imbalance.

Fiscal deficit and the path of its size in relation to Brazilian gross domestic product (GDP) must be addressed, as the sustainability of government debt usually impacts exchange rate and inflation. A feasible reduction of fiscal deficit must be part of central government commitment, amongst other measures, to guarantee public debt is payable.

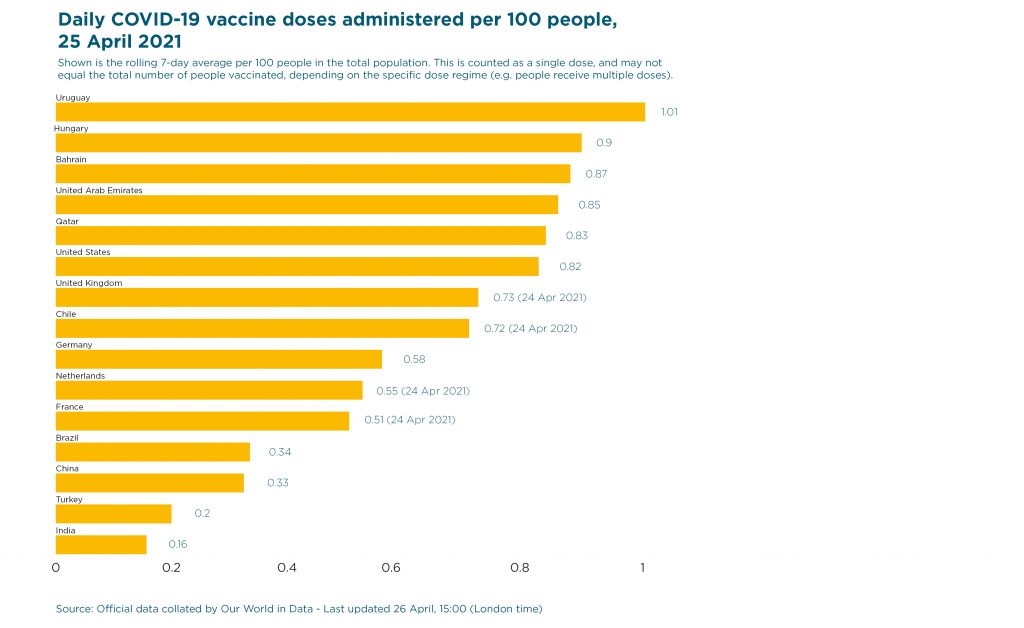

The economy is expected to resume its growth path when vaccination rollout gains traction. Social distancing has affected several economic sectors and lockdowns are still being used to control the spread of the disease.

Although mass vaccination may pave the way to resume normal life, the agenda of sustainable growth depends on reforms – namely tax reform and administrative reform (to reduce the cost of the public sector). Tax reform is expected to raise productivity and to bring more social justice to the tax system. Parliament will be key to ensuring both proposals will be discussed during 2021.

Even with such an uncertain future, business opportunities are arising. To be more specific, the financial sector, and the potential to provide services to a large consumer market, is witnessing the rise of FinTechs (Financial technology - use of technology to improve financial services). Venture capital investments are soaring, with start-ups investing heavily in technology and innovation.

The technology revolution of the internet and the massive use of smartphones have made it possible to access the consumer market. Traditional banking may face a relevant change to its strategies, dealing with large fixed costs and branding issues. FinTechs are challenging incumbent players, with a positive impact on consumers and the economy.

The Brazilian Central Bank (BCB), in an unprecedentedly strategy, is backing all initiatives that may lead to a more competitive banking industry. The outcome expected will lower borrowing and transaction costs for companies and will boost investments in technology and innovation. This “revolution” has the potential to fill in an important gap in Brazil´s corporate culture as start-ups are focusing investments in technology, that may bring competitive advantages and the emergence of technological innovation.

This report is divided as follows:

- Macroeconomic outlook;

- Regulatory environment;

- Foreign direct investments;

- FinTechs landscape.

Brazil´s macroeconomic outlook

The COVID-19 pandemic upended the Brazilian economy as its growth is staggering since 2012. For the year 2020 negative growth was -4,1%. This result was mitigated due to the stimulus package released last year. Brazil´s package was the largest among the G-20´s emerging economies (8,3% as a share of GDP). When compared to its peers in Latin America, the Brazilian economy shrank less.

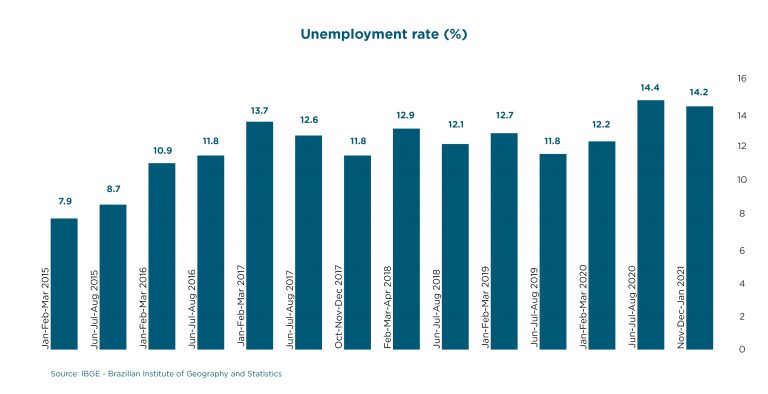

Fiscal imbalance, aggravated by the stimulus package, brought uncertainty to the market with impact on interest rates and the exchange rate. Brazilian Real (BRL) devaluation and its correlation with tradeable goods prices negatively affected inflation. Consumer price index rose 4,52% in 2020. Estimate for 2021 is higher (5%). In response, Brazilian Central Bank (BCB) raised SELIC (Brazilian federal funds rate) rate to 2,75% (previously set in 2%). Controlling inflation with a weak recovery of economic activity will impose an extra burden on an already high unemployment rate (14.2%).

Resuming economic activity will rely on vaccination rollout and addressing the problem of fiscal deficit. Without these the economy will continue suffering the social distance/lockdown effects and exchange rate and financial conditions will sustain high inflation rates. As already mentioned, BCB´s remedy is to raise SELIC, affecting consumption and investment. This vicious cycle imposes a challenge to policy makers and is not unusual in Brazil. In fact, dealing with the fiscal subject seems to be the major problem, with inflation, exchange rate devaluation and unemployment, being by-products.

Market expectations

Vaccination rollout

Immunisation becomes an important economic indicator once full economic activity depends on social interaction. Some countries have taken this subject strategically (e.g. England, Israel, United States) with good results that should be reflected in economic recovery.

Initially, the Brazilian central government chose the Oxford-AstraZeneca vaccine to be its main immunisation drug, leaving aside negotiations with all other producers. In parallel, São Paulo State engaged with the Chinese producer “Sinovac Biotech” to produce this locally. As of today, 80% of immunisations are from Sinovac and 20% are from Oxford-AstraZeneca. Production of both is not continuous as the raw material needed (IFA – Active Pharmaceutical Ingredient) is imported and some delays are being observed. For this reason, immunisation is not following the desired path.

The corollary for this situation is a sluggish economic recovery, with social distancing measures and lockdowns still being applied in several regions of the country.

Regulatory environment

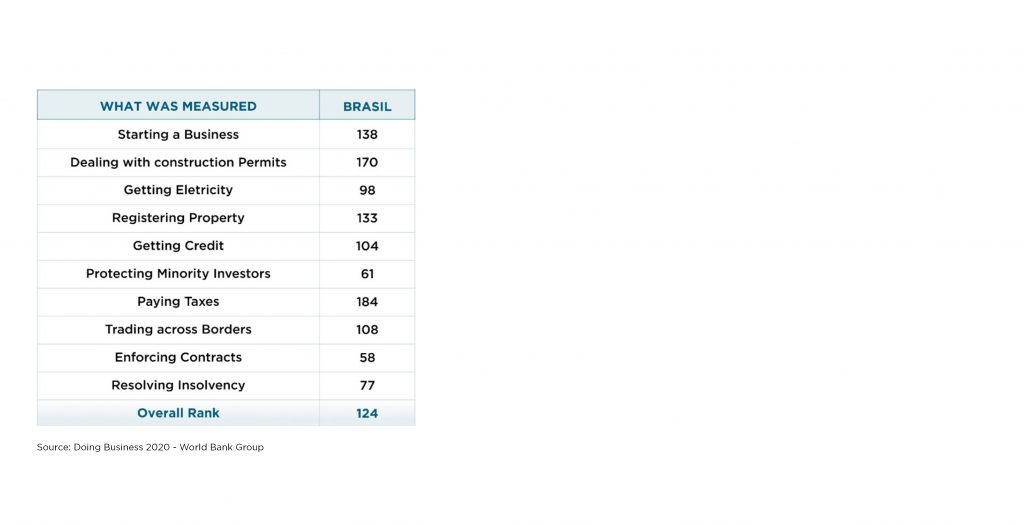

Brazilian businesses have been dealing with lots of regulation, a legislation difficult to comply with and bureaucracy. Not only are there lots of taxes to be calculated, but also companies must prepare and deliver ancillary obligations in time. The time allocated in these activities, and the resources spent, amount to an unnecessary and unproductive number of hours. Tax reform should also deal with outdated paperwork.

Anachronic bureaucracy translated into a struggle to obtain environmental and construction permits to start a new business (also to liquidate one) reflecting a needed change of mentality and the introduction of modern processes in the public sector.

Differences in culture and productivity between private and public sector must be addressed. The administrative reform of the public sector must not only reduce public spending with servants, but should also introduce mechanisms of motivation to improve public services.

Overall regulation and the comparison with other economies is better captured by the report “Doing Business” issued by The World Bank. As stated on this report:

“Doing Business presents quantitative indicators on business regulations and the protection of property rights that can be compared across 190 economies— from Afghanistan to Zimbabwe—and over time”.

Figures below represent each item measured and its rank among 190 countries. An overall rank is given to each country in accordance to the World Bank method.

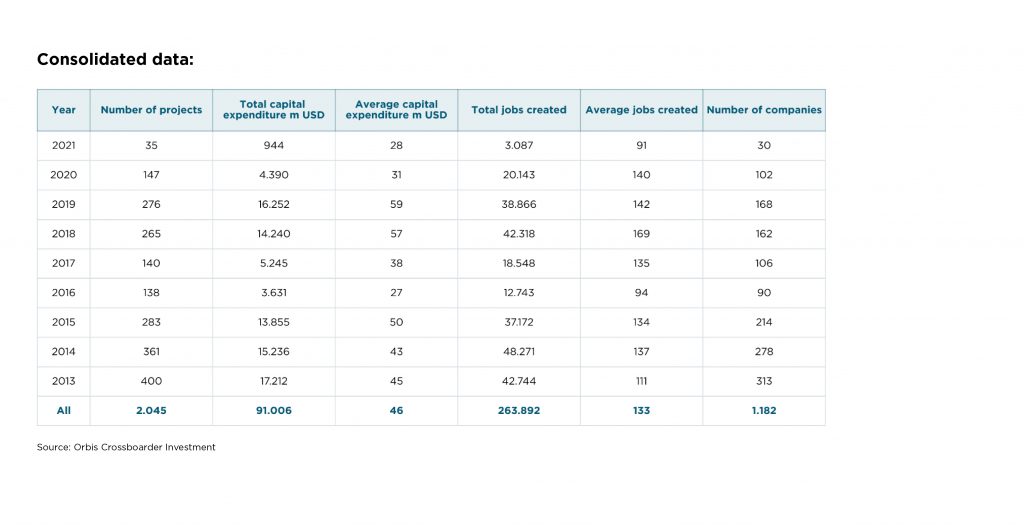

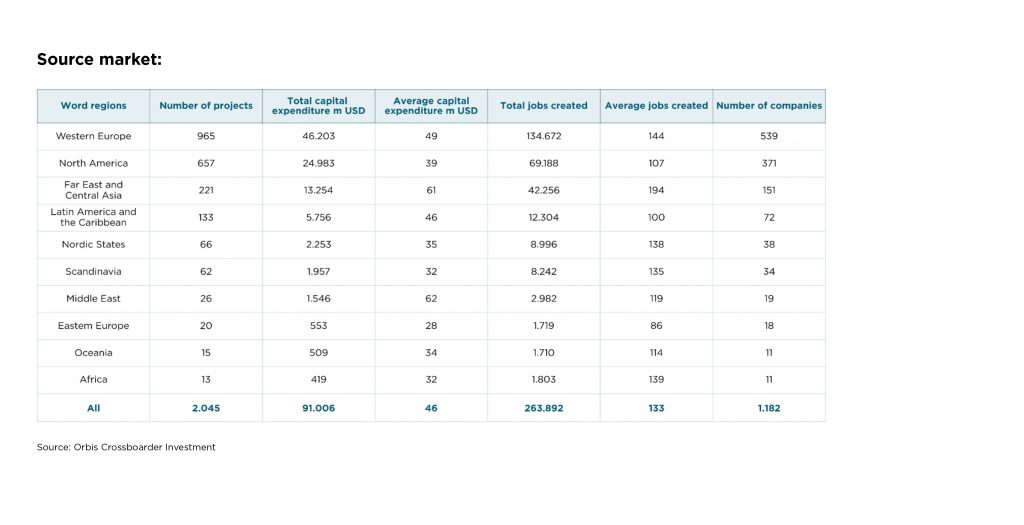

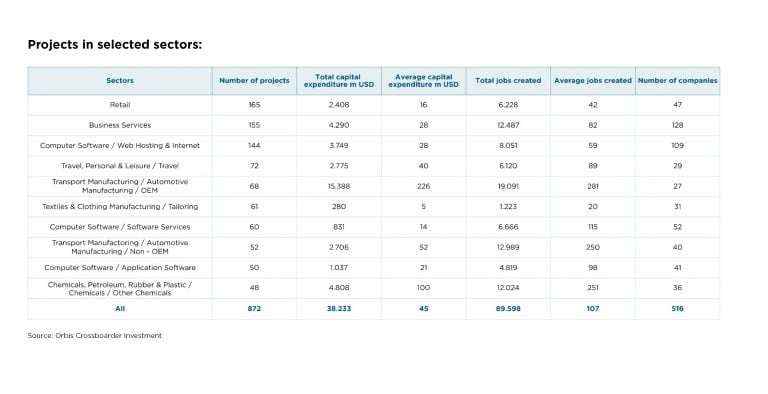

Foreign direct investments into Brazil

The Covid-19 crisis will negatively impact FDI inflows during 2021. Rearrangements of supply chains will be key to FDI prospects. Also, M&A projects have been suspended. Challenging operational and logistic conditions, and strategical reallocation of capital will tighten the inflow of capital.

Brazil, with its environmental policies being criticised, may struggle to attract capital, as society and corporations are monitoring how countries deal with the environment. Political turmoil and mismanagement of pandemics will also adversely affect inflows.

(Information below comprises completed projects)

FinTech's landscape

The Brazilian banking industry enjoys very weak competition, since it is highly concentrated. For decades regulators (Brazilian Central Bank to be specific) saw a conflict between competition and systemic risk. Mergers and acquisitions occurred freely. Predicted outcome materialised: high bank spreads, poor quality service, fees and charges of all kinds and low investment in innovation.

On the other hand, demand for financial services, mainly online, has risen substantially during the pandemic. Even informal workers granted with emergency aid from federal government during 2020, most of them with no bank account, had to download an “app” to manage funds.

The response to this market structure, and line of services provided by traditional banks, came along with a vibrant venture capital industry and an unprecedented entrepreneurial spirit. It was obvious that a great market was unattended and that major banks were too conservative to reach it. FinTechs have risen to fill this gap and to compete with incumbent players.

Funding, technology and innovation, together explain the emergence of start-ups with a focus on financial services. However, important help came from the regulator. The Brazilian Central Bank has been supporting this important market change, through friendly legislation and several initiatives (see box Agenda BC#). At the end of the day, a more competitive market will emerge, with lower prices, better intermediation and more efficient resource allocation.

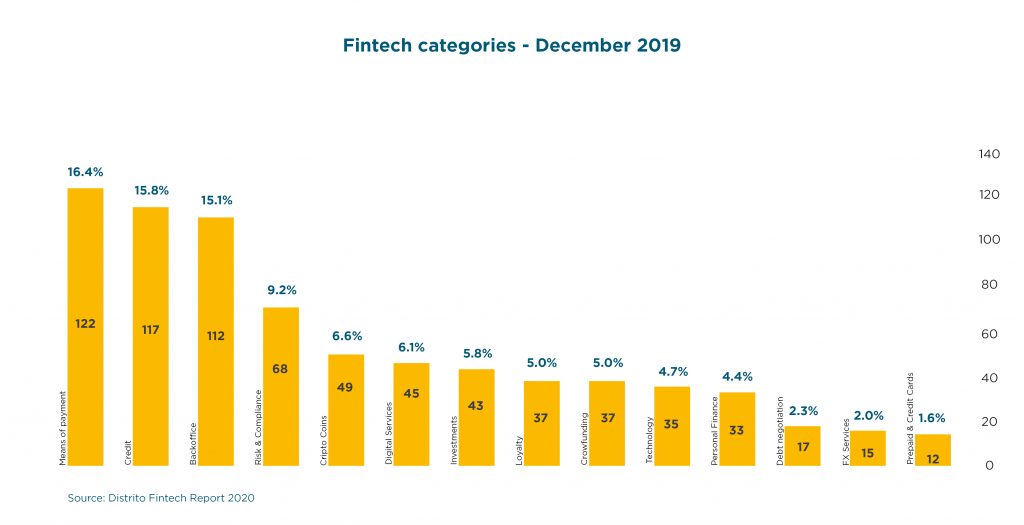

The FinTech market is extremely segmented with a wide range of services and subcategories:

- Backoffice (accounting, financial management, pricing);

- FX services;

- Cross border payments;

- Prepaid and credit cards;

- Credit (P2P lending, marketplace, anticipation, consortium);

- Crypto Coins (brokerage, investments, payments);

- Crowdfunding (equity crowdfunding, project crowdfunding);

- Debt negotiation;

- Customer loyalty (benefits program, loyalty program);

- Personal finance;

- Investments (financial assets, investment management, marketplace);

- Means of payment (mobile, processing);

- Risk and compliance (risk analysis, antifraud);

- Digital services (digital banking, eWallets);

- Technology (banking as a service, open banking).

According to a report from ABVCAP - Associação Brasileira de Private Equity e Venture Capital (Brazilian association of venture capital and private equity) and KPMG, the year of 2020 registered an impressive amount of venture capital (traditionally focused on start-ups) investments (BRL 14.6 billion). This amount was higher than the total investments in private equity (BRL 9.1 billion). The appetite for high risk shows the potential of returns from this market. Technology and regulation lowered entry barriers. Traditional banking needs to be reinvented or needs to partner with start-ups.