Europe: Driving growth through workforce resilience and innovation

HLB Survey of Business Leaders 2025European leaders started the year with muted confidence. Only 39% expect an increase in global growth, against 49% of respondents in other regions. Regional economic growth has been sluggish. Eurozone GDP increased by 0.8% in 2024 and may accelerate to 1.5% in 2025. The UK may reach 1.6% GDP growth in 2025, after a weaker-than-expected 2024.

The operating environment has been indeed challenging due to changes in global trade and renewed geopolitical risks. Economic uncertainty dominates the risk radar at 79%. However, concerns over inflation cooled off by 18 percentage points compared to last year. In the UK, inflation is predicted to remain at 2% through 2025 and in the eurozone — at 2.1%.

72% of European leaders continue to be apprehensive of geopolitical risks including wars and conflicts. 66% are also concerned about resource costs due to supply chain issues, potential US tariff hikes, and pressures to de-risk from China.

However, these trade developments benefit some countries. As businesses seek new partners, Central Eastern European countries are emerging as nearshoring destinations with friendlier policies and skilled labour.

Despite a more challenging landscape, growth opportunities are out there. Leaders will need to get more prudent with spending to protect profit margins and fund innovation. To accomplish this, they are focusing on improvements in three areas: operating model, workforce management, and innovation.

Innovating for growth

European leaders aim to rise above the tough market conditions and continue to reinvent themselves. To grow this year, leaders plan to improve operating efficiencies, invest more in their people, and achieve greater organic growth.

A programme of active reinvention will be required to drive these imperatives forward. A worrying number of leaders in the region (30%) consider themselves to be successful innovators and 56% rate their efforts as variable. The majority seek to improve their innovation through targeted interventions.

Those focusing on improving how they innovate are quickly identifying and testing ideas to determine which to pursue, often with the help of AI. Among companies planning to use rapid prototyping and testing, 58% aim to do so with AI. Similarly, 64% plan to use AI to track future trends, and 60% — to set up and operate an innovation lab. However, not all European leaders are equally ‘sold’ on the value of AI.

Divided views on AI

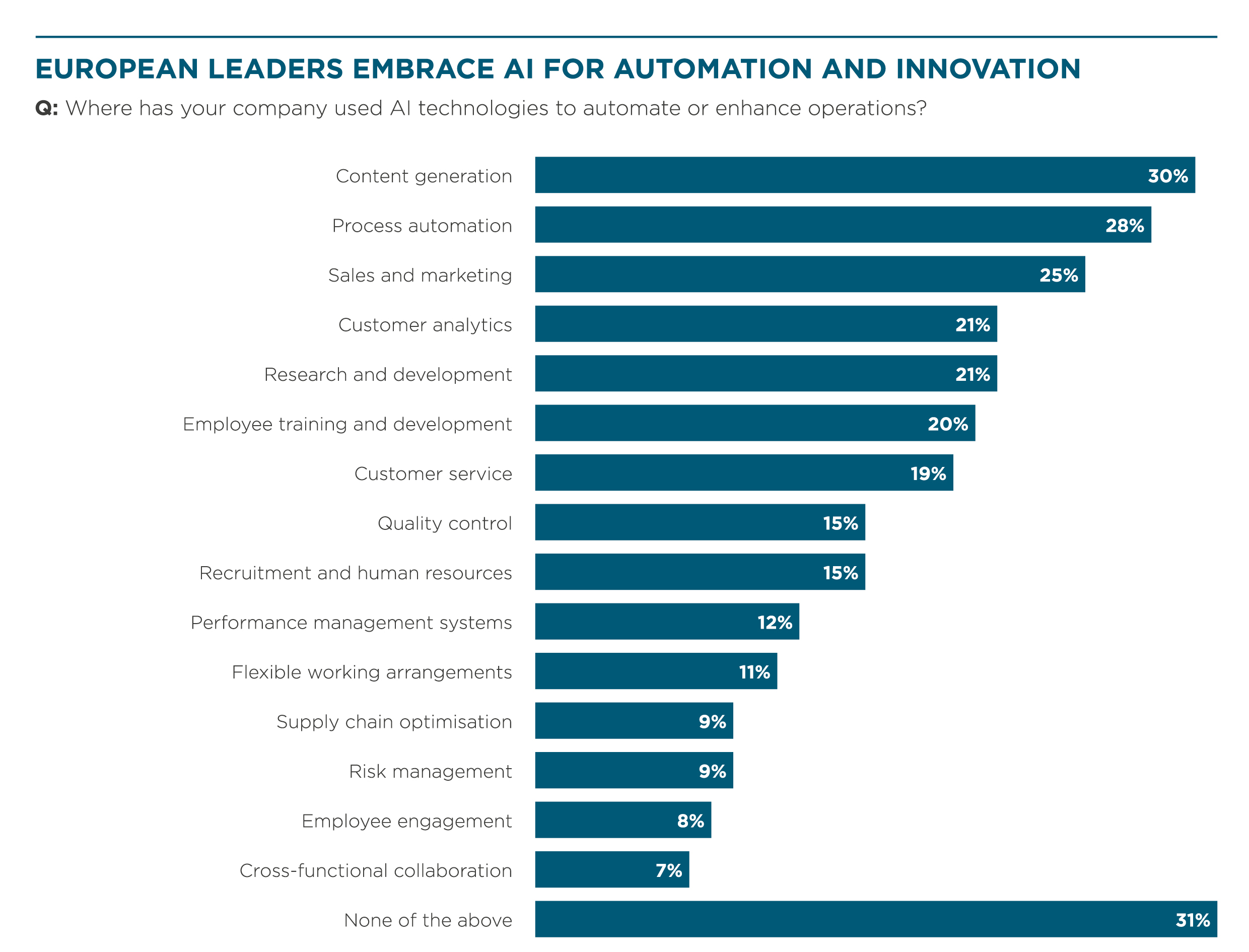

In a five-year perspective, 68% of leaders consider AI as the most important business technology. But in the present, perspectives diverge. 38% of respondents are already widely using or allocating resources for AI adoption while 20% express caution or even aversion to AI technologies.

Compared to last year, AI adoption has increased content generation (up 9 percentage points year on year), research & development (up 7), recruitment and HR (up 11), and process automation (up 5).

“We implemented bespoke GPT chatbots to overhaul content strategy across all products. This spans not just topic clusters of articles and detailed product descriptions, but also video scripts, research, planning, etc,” shared a Manufacturing CEO. For a business in the automotive sector AI is delivering “significant reduction in downtime and unexpected costs by analysing machine data and optimising our production processes”.

The first provisions in the EU AI Act took effect on February 2nd, 2025. Follow-up rules will apply from August 2025 and onward. The law’s perception has been polarising.

Critics argue it will further exacerbate the costs and time-to-market for AI applications, discouraging new entrants. Proponents counter that it creates a healthier, more ethical environment for innovation with built-in controls for privacy, transparency, and non-discrimination.

Despite the constraints, regional AI players have emerged: Mistral AI (large language model), Stability AI (stable diffusion image-generating software), and Graphcore (AI chip development). European businesses are successfully demonstrating how AI can be brought in to invigorate their product and service portfolios. Siemens has embedded AI into industrial applications, including building management systems, energy management solutions, and manufacturing control systems.

European leaders shouldn’t miss out on AI opportunities for data-driven decision-making and process optimisation due to uncertain regulatory or financial climates.

Operating model transformations

58% of European leaders are concerned with access to talent more so than global peers who rank this risk 10 positions lower. By 2040, the EU workforce is projected to shrink by 2 million workers annually due to retirements and fewer graduates. The rapidly ageing population strains local governments’ social systems and poses equal challenges for businesses. Many risk losing significant institutional knowledge and skills faster than they can replace them.

This potential loss of institutional and process knowledge has dire consequences for the economy. During the 2008-09 financial crisis, most of the staff at HM Treasury in the UK had never experienced a recession or banking crisis, resulting in avoidable policy mishaps. More recently, Boeing suffered from grave quality problems compounded by massive worker departures during the pandemic.

Skills mismatches, missing competencies, and lack of experience create productivity issues. Europe has experienced slower productivity growth over the last two decades, compared to the US and China, which has held back competitiveness, according to Mario Draghi’s investigation.

“The core focus of a competitiveness agenda should be to raise productivity growth, which is the most important driver of long-term growth and leads to rising standards of living over time."

European leaders are 1.2X more committed to investing in their people this year to grow, while 40% consider talent acquisition as a weakness.

Ongoing talent shortages and local regulatory hurdles prompt companies to seek alternative strategies. “In France, more and more companies are entering partnerships with academic institutions to attract and nurture diverse talent. For skills in shortage — like IT and data analytics — leaders often expand talent search across and beyond Europe,” noted Laurent Capbern of HLB France.

Many businesses have also moved their manufacturing facilities elsewhere. Others have built a global network of suppliers for core product components.

Talent upskilling

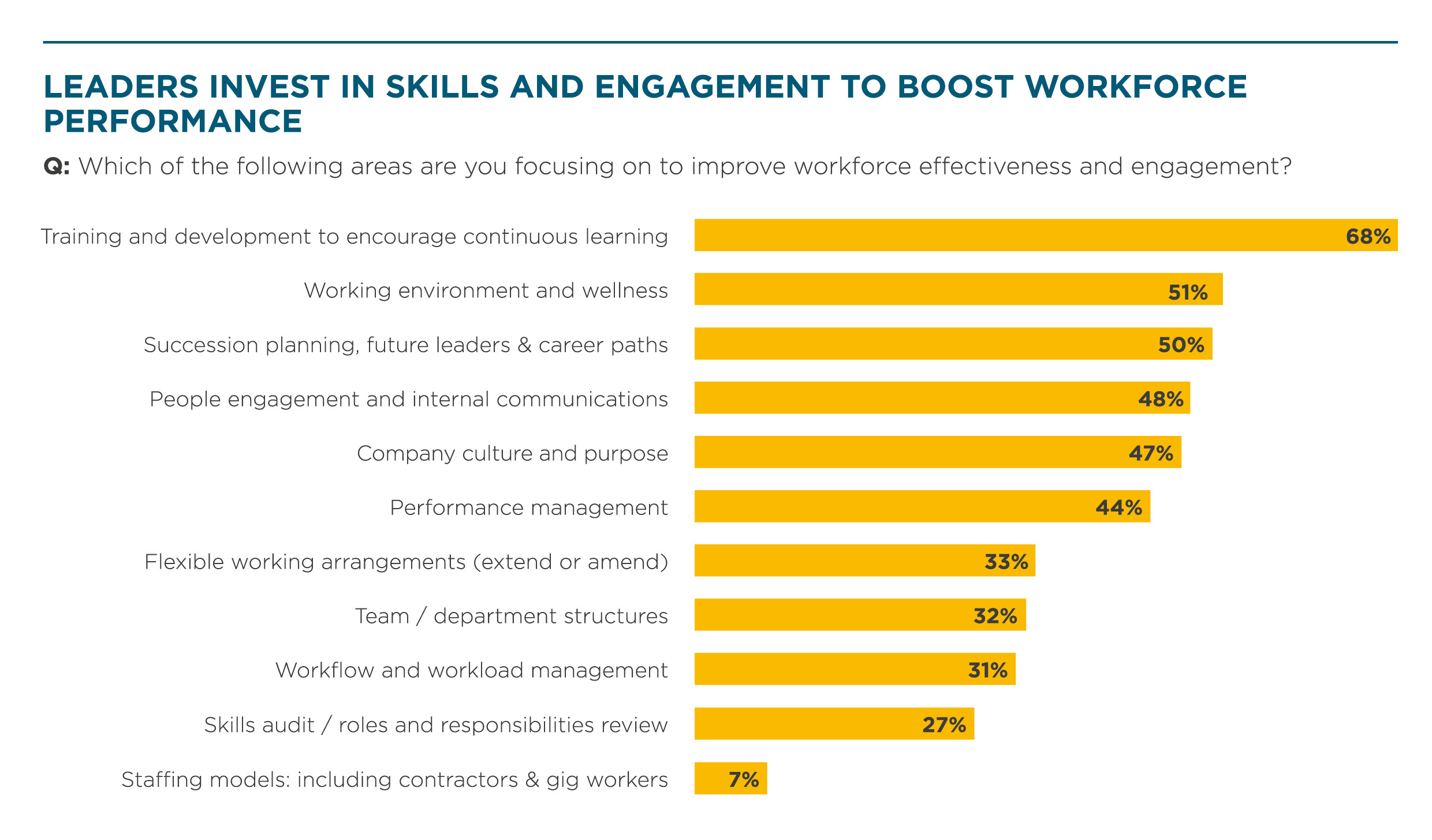

Among respondents, 40% view their people as ‘high performing and engaged’ and 56% as ‘productive, depending on circumstances’. Most want to tilt that scale in the next 12 months through targeted people management initiatives.

To improve their workforce effectiveness and engagement, 59% plan to invest more in employee training and development. 52% also aim to change the company culture and 48% seek changes to people engagement and internal communications.

Retraining and upskilling initiatives can effectively address skills shortages but may face cultural resistance. Some Europeans lack a ‘life learning mindset’ as more emphasis has been traditionally put on formal learning. People often feel ‘done’ after graduating from university or vocational institutions. Job-related training participation rates hover at 25% to 50% across most EU states — below the target of 60% set by the EU government.

Government initiatives like the Skills Agenda and Pact for Skills in the EU and an AI Upskilling fund in the UK can help companies fund employee reskilling.

Such investments could provide leaders with the funding they need to support other important people initiatives on the 2025 agenda: improvements in workplace environment and wellness (46%), better succession planning (44%), and performance management initiatives (43%). These are worthy intentions to improve employee retention and avoid further turnover and loss of expertise.

Optimising for efficiency

European businesses face ongoing challenges to sourcing strategies, risk management, and governance. The impacts of interrelated crises are still palpable: Only 14% consider their operating models as running at optimum, and 83% rank it as needing improvement.

To maintain strong financial performance, business leaders are restructuring and streamlining processes to build leaner, future-ready business models. 40% of leaders in Europe are committed to improving weaknesses in their operating efficiency. This is up by 5 percentage points from last year. Half seek organisational structure improvements and 46% are looking to streamline processes to improve how they are operating.

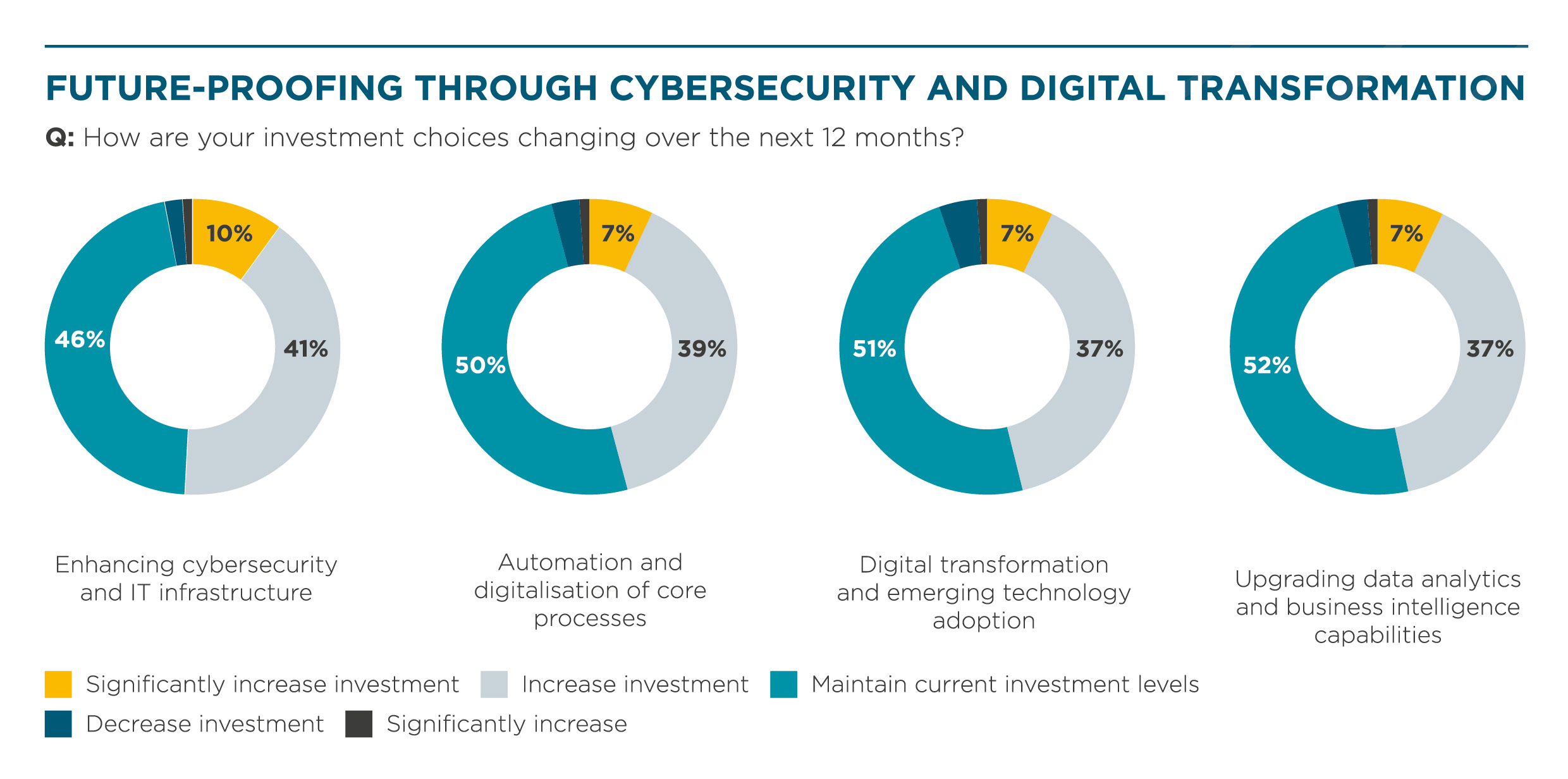

European leaders face a ‘steepening trajectory’ in digital transformation to remain agile and competitive. 48% plan to update their technology systems in 2025. They put high hopes in emerging technologies as a conduit for greater business agility and resilience. In the next 12 months, increases in investment are planned in the following areas: cybersecurity, IT infrastructure, process digitisation and automation, and ongoing digital transformation.

When it comes to deploying AI to streamline operating models, 40% of business leaders in Europe are targeting enhancements to data analytics capabilities and 67% of this cohort are looking to AI to help them with this.

41% are trying to enhance business agility and over half of them are using AI to make this happen. AI can unlock deeper customer and market insights for strategy refinement. When embedded in digital workplace tools, the algorithms could also generate greater process efficiencies and enable new customer offerings.

Cybersecurity imperative

Digital transformations heighten security risks, yet companies are delaying investments in cyber protection in favour of other initiatives. Among companies whose profit margins increased by 5% or more last year, 16% plan to significantly increase spending on enhancing cybersecurity and IT infrastructure versus 3% of companies whose profits declined by 5% or more. An HLB Cybersecurity Survey also found that only 24% of businesses run ongoing cybersecurity awareness programmes.

“Cybersecurity risk is prolific and widespread, but companies only make investments when there's either an attack or a threat of an attack,” observed Mark Butler of HLB Ireland. Of companies that failed a compliance audit last year, 31% had a breach that very same year. Comparatively, just 3% of those passing audits had cybersecurity issues,

For the most profitable companies in our survey, their competitive edge comes from collaboration.

Profit Accelerators are 1.2X more likely to cooperate with other enterprises and organisations on innovative initiatives. Compared to peers, Profit Accelerators are further along on the digital maturity curve.

They’re also 1.6X more likely to rely on outsourcing to grow this year. But because of a greater reliance on ecosystem partners, they’re 1.8X more likely to view their supply chain as a weakness and seek improvements in this area.

A fifth of the leaders in Europe are in our ‘Profit Accelerators’ segment — companies whose profit margin increased by 5% or more this past year. Discover the strategic secrets behind maximising profit margins; download our in-depth report

Related content

Learn more about our research