Continuous transformation

The survival response for business leaders in LATAM - HLB Survey of Business Leaders 2023Latin American (LATAM) economies have continuously demonstrated resilience amidst ongoing socioeconomic disruptions. However, 2023 will likely be another challenging year. The International Monetary Fund expects a two per cent growth slowdown in the region.

Despite the challenging economic circumstances, our survey indicates that leaders based in LATAM have a distinctively buoyant outlook compared with their global peers. Half believe that global growth will increase in 2023 (vs only 27% globally), whereas only 20% expect a decline in global growth rates, expected by over half of global respondents in our survey.

Expectations of their company's performance are also more optimistic. A small majority (51%) are very confident in their ability to grow company revenues in the next 12 months versus 29% of global respondents, while another 41% are somewhat confident. LATAM levels of self-confidence are a sharp contrast to the North American and European leaders, who are the least confident in our survey cohort.

Perhaps LATAM leaders are more focused on the silver lining. Though the impacts of the pandemic knocked GDP back in 2020, growth in most countries bounced back in 2021. According to S&P Global, Peru recorded GDP growth of almost 15% in 2021, while GDP growth in Argentina, Chile, and Columbia hovered at 10%.

Many expect a more muted prognosis for 2023. According to The Economic Commission for Latin America, real GDP growth for the region is estimated at 1.3% in 2023, reflecting ongoing economic uncertainty.

Key risks: Geopolitical events and inflation

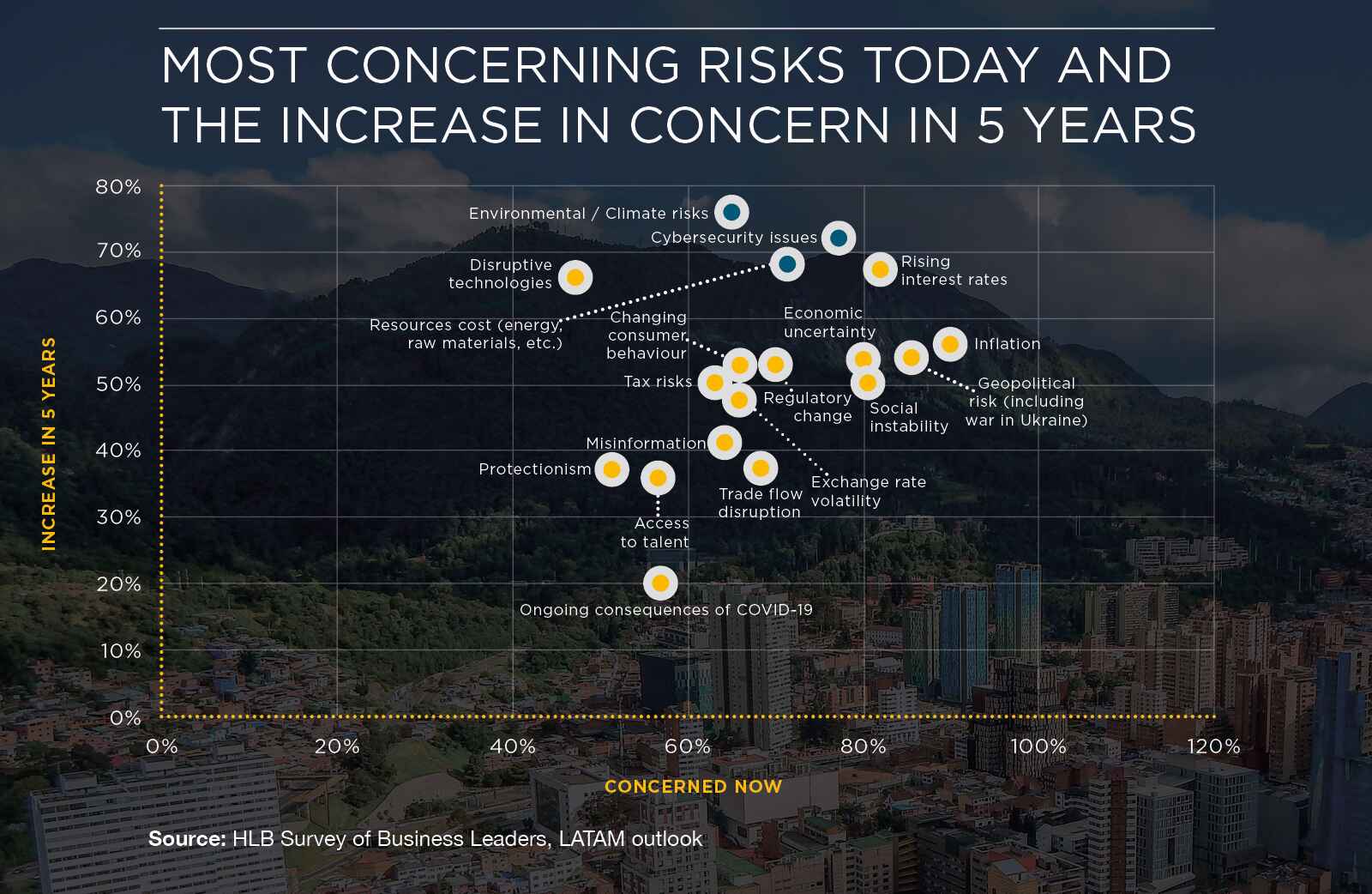

Despite a more positive outlook on the global economy, business leaders in LATAM acknowledge significant challenges to their business prospects. Among respondents, 84% are concerned with geopolitical risks, both domestic and international, such as the war in Ukraine, which concerns 44% of our LATAM sample, double their global peers.

Despite the geographical distance, the ongoing conflict in Europe continues to disrupt the supply and prices of food, fertilisers, and energy. The United Nations Development Programme has identified two other dimensions of impact: worsening fiscal indicators and reduced net capital flow into the region.

Strained relations between the United States and China, both valued trade partners, are also impacting the region. China has introduced their ambitious Belt and Road Initiative across Latin America, with 20 out of 24 countries in Latin America and the Caribbean region signing up for participation. By contrast, private investment from the US has slowed down, due to growing economic uncertainties in the region. The emerging bipolar world outlook leaves Latin American business leaders with tough choices.

Overall, perceived risks among LATAM leaders are elevated across the board, compared to global peers. Over 30% are simultaneously very concerned with geopolitical risks, inflation, cybersecurity issues, resource costs, economic uncertainty, and rising interest rates. Globally, only three issues — inflation, resource costs, and economic uncertainty — are seen as very acute by 30% of leaders.

Moreover, LATAM leaders are more worried about further risk amplification in the five-year perspective. Compared to the global cohort, each of the top-five future risks including climate change, cybersecurity, rising interest rates, disruptive technologies, and resource costs rank at least ten percentage points higher than global peers.

Inflation, economic uncertainty, and exchange rate volatility aren’t new regional obstacles. Now there’s also a political component. Brazil has just emerged from a challenging General Elections, where the left-leaning former President Luiz Inácio Lula da Silva was elected by a slim majority of votes (50.9% vs 49.1%). The pre-election run reignited tensions, social unrest and polarisation in society. The concerns the Brazilian society has about inequality, deforestation, and political unrest remain high.

Chile has also experienced a series of major political protests (Estallido Social) throughout 2019-2022, which began in the capital, but later spread through the country. As reported in the Wall Street Journal, Chileans took their dissatisfaction to the streets, in particular — around the rising cost of living, high unemployment rates among university graduates, inequality, and privatisation among other concerns.

High political instability in the region affects the economic outlook of many countries in Latin America. Inflation has accelerated, growing at its fastest pace in over 20 years. It’s no surprise that 93% of survey respondents are worried about inflation risks, of which 43% are very concerned.

J.P. Morgan expects a 4.1% inflation in the region in 2023. However, as Bloomberg Linea reports, the numbers vary a lot on a country level e.g.:

- Bolivia – 3.6%

- Brazil – 5.48%

- Chile – 5%

- Colombia – 8.89%

- Costa Rica – 6%

- Mexico – 5.1%

- Honduras – 8.29%

- Panama – 3%

It is also likely that interest rates will peak in early 2023, but remain in low double digits through the end of the year. Among survey respondents, however, 67% expect rising interest rates to remain a problem in a five-year perspective.

Growth is likely to slow under the pressure of high interest rates and falling commodity prices. Unemployment rates remain high, which further weakens consumer spending on goods and services. A slowdown in trade with the US and Euro area partners will also restrain growth.

To power forward through choppy waters, governments in Latin America will have to exercise prudent fiscal policy, with an emphasis on social spending to prevent further social instability and, at the same time, attempt to reduce public debt and slow inflation. The economic outlook for business leaders is dependent on their success (or lack thereof).

Using transformation to survive and thrive

Business leaders in Latin America face recurring disruptions. To overcome them, the majority is looking to transform.

“Be open and never stop growing or learning. Seize opportunities as they come and make opportunities if they don’t appear,” according to an energy sector CEO. “Life won't be about travelling one steady path anymore, but the focus should be on the travelled path always being upward."

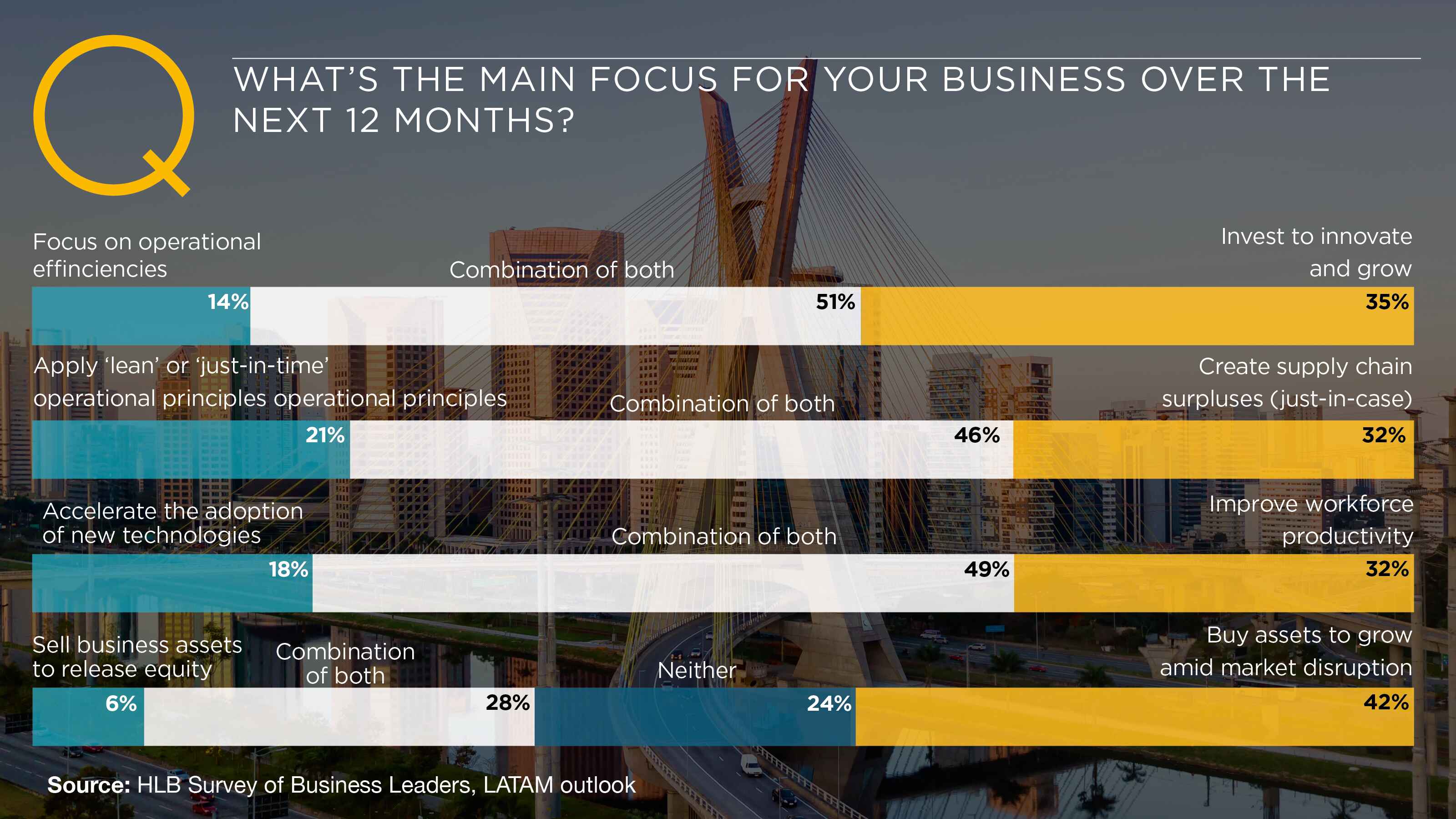

In the next 12 months, 95% of business leaders are focusing on transformation including 61% for whom transformation is their sole focus (as opposed to survival activities). 34% plan to simultaneously focus on survival and transformation. This is a contrast to global findings, where only 40% of leaders are exclusively committed to “transformation”.

LATAM leaders also appear to be more active on the M&A front. 70% of leaders in LATAM plan to both buy business assets to grow and sell some to release equity. Among them, 43% are solely purchasing available assets amidst the disruption., which indicates a more proactive attitude compared to the global cohort, of whom only 24% plan to buy new assets in 2023.

At the same time, 49% of LATAM leaders are more forward-looking and plan to focus on longer-term priorities to thrive, while another 43% will do so in combination with clearing out short-term, survival-critical priorities. Only 9% are focused on imminent survival.

It appears that LATAM leaders are more willing to embrace the “offensive” measures of diving head-first into the rough seas, rather than trying to just sail in between the high waves.

When asked how LATAM leaders plan to achieve growth and profitability in the next 12 months, the majority (73%) selected improvements in operational efficiency. Also, a third perceive their operational effectiveness as an area of weakness requiring addressing within the same period.

A focus on efficiencies is understandable, given the market conditions. Economic uncertainty remains a concern for 80% of respondents. Moreover, local leaders are bracing for a prolonged disruption. 63% expect resources cost to increase in price in 5 years’ time.

Likewise, over half of the leaders expect regulatory and tax risks to become more prominent in the future. With budget challenges for new governments, business leaders are preparing for tax increases required to fund new social initiatives. With the exception of Mexico, most administrations in the region govern without control of their domestic congresses, increasing the risks of policy gridlocks and potential uncertainty in legislation. Respectively, LATAM leaders are trying to establish leaner operations to account for future risks in this area.

Inflation, high-interest rates, and currency volatility progressively erode available cash flows. 49% of LATAM leaders also plan to optimise costs this year. 46% are focused on optimising their supply chains by balancing between “just-in-time” and “just-in-case” practices.

Nevertheless, LATAM leaders are also trying to position their businesses for the next growth cycle. 50% maintain a dual focus on improving operational efficiencies and investing to innovate and grow. Another 36% are only focused on innovation — an aspiration, which likely drives some of the earlier-mentioned M&A activity.

The dual focus makes sense as business leaders in the region want to strengthen their capacity to innovate, selected as an area requiring improvement by almost a third of leaders in LATAM. In last year’s survey, 69% of LATAM leaders agreed that market disruption motivated them to innovate — with digital technologies as the key enabler.

Investing in new technologies to drive competitiveness

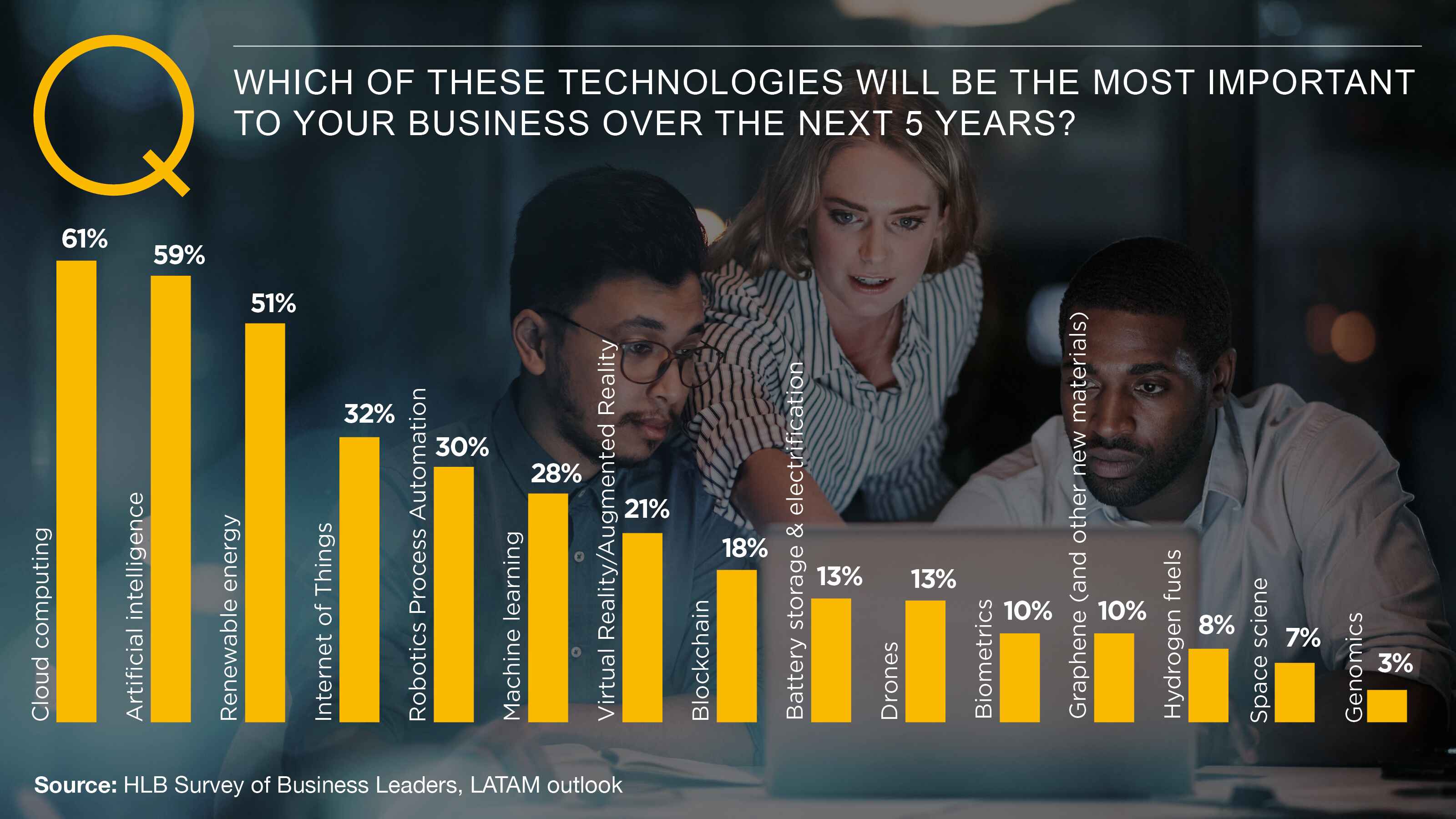

The second top-selected action for achieving growth this year is new technology adoption. As recent history has proved, strategic technology investments can bring major acceleration to business transformation and future growth.

Investments in new technologies could also help businesses improve the quality of produced goods and services. With a rapidly expanding middle class and an influx of foreign investment, LATAM is seeing a boom in e-commerce and digital media businesses. Brazil already has the 12th largest e-commerce market size with a projected revenue of $47.64bn in 2023. Among our survey respondents, nearly half plan to launch new products and services in 2023, in order to grow and remain profitable. This is five percentage points higher than their global peers.

Though given the muted global growth projections, LATAM leaders will have to carefully manage their innovation. One CPO warns “Be aware of the market, of what your customer wants. Use creativity to bring new alternatives to the market, while also keeping that foot on the ground”.

Leaders in the region are also more inclined to form strategic alliances than their global peers: 49% have the intention to do so vs only 26% globally. Strategic alliances are largely seen as an opportunity to achieve the earlier expressed revenue growth aspirations, together with local and international partners.

Traditionally, LATAM has been seen as an attractive region for commodities and energy sourcing. According to Standard & Poors, over the five-year outlook, investments in renewable energies, critical minerals, and advanced manufacturing sectors will increase.

Yet, new opportunities are emerging in the areas of digital services exports, as well as circular economy, electromobility, and renewable energy. Firms from China, South Korea, Japan, and Australia are increasing investments in Latin America. Though mining attracted the most investment, it is closely followed by investment in sectors like hydrocarbons, automotive, and telecommunications.

Nearshoring could also increase LATAM’s total exports by $78 billion per year ($64 billion in goods plus $14 billion in services) in the near and medium term. The region is a well-known hub for providing competitive Business process outsourcing (BPO) and IT services to global companies. Statista forecasts that Mexico will generate $3.5 billion in revenues from BPO in 2023.

To deliver superior goods and services, LATAM leaders are looking to the following technologies in the next five years: “cloud computing”, “artificial intelligence”, “renewable energy”, the “Internet of Things”, and “robotic process automation” among others.

The flip side of rapid digital acceleration, however, are the rising cybersecurity risks. 79% of LATAM leaders are already concerned with cybersecurity issues. A further 71% expect cyber-risks to become even more prominent in 5 years. Plus cybersecurity is the top area of weakness business leaders in LATAM wish to address in 2023.

In 2022, the government of Costa Rica had to declare a state of national emergency after a series of ransomware attacks against the country’s tax collection, customs, and social security agencies. Regional businesses also suffer from cyber-warfare. Over 85 billion attempted cyberattacks were registered in Mexico between January to June 2022 and 31.5 billion — in Brazil, according to Fortiguard labs. Business leaders must improve their cyber protection before investing in new IT technologies or they risk costly data breaches and subsequent reputational damage, which could alienate partners.

Harnessing ESG (Environment, Social & Governance) to account for good strategy

Non-digital risks too can derail LATAM leaders’ ambitious growth prospects. Among respondents, 74% expect climate and environmental issues to become more acute in 5 years’ time.

The OECD estimates that thirteen out of the 50 countries most affected by climate change are in the LATAM and Caribbean region. Droughts (and subsequent water shortages) have become increasingly common and affect the region’s substantial agriculture sector. Countries have been dealing with extreme rainfall, land, and marine heatwaves, often within the same year.

It’s not surprising that business leaders are now more committed to exploring alternative energy solutions. Half view renewable energy as one of the most important technologies for their business over the next five years.

A sound 50% of LATAM leaders are also making progress toward becoming carbon neutral in the next five years. Local energy sector CFO said their business is already “pursuing construction of new electricity generation projects, powered by renewable sources”. While a CPO in the transportation sector mentioned that their company “looks for ways to reduce carbon production, tests new environment-friendly products, and migrates to using more solar energy.”

Others mentioned that they’re “contributing solutions for global regeneration”, “established a structural area in the company that focuses exclusively on ESG” and “adopted green labelling, promote water reuse”.

A transition to green energy can be an environmental and social game changer for the region. LATAM already has a good mix of sources, with OECD estimates for renewable energy resources representing 33% of its total energy supply compared to 13% globally. However, local countries registered total greenhouse gas (GHG) emissions of 61% between 1990 and 2019. Though LATAM’s share of total GHG emissions remains proportional to its share of the population, it can be further improved.

That said, the “green transition” should not be limited to combating climate change, but also address the wider social issues — the Social and Governance components of ESG.

Rising resource costs are affecting the citizens and communities, thereby accelerating social instability. Increasing poverty, lack of meaningful work opportunities, and high cost of living are the reasons behind many of the recent protests in the region. To thrive operationally, LATAM leaders will also have to extend further support to the local communities.

Soundly, among respondents, 46% are equally committed to improving business performance alongside ESG impacts, though another 31% are more focused on business improvements alone. A predominantly combined focus shows that these aren’t mutually exclusive objectives. The green transition has the potential to improve the social outlook in the region including the opportunity for creating new (and often better-paid) jobs.

Unlike global peers, LATAM leaders have fewer constraints with access to talent. Only 21% cited weaknesses in talent acquisition vs 35% globally. The majority (51%) also expect talent-related risks to stay the same in a 5-year perspective.

That said, leaders also recognise that they will need to cultivate a more competent workforce to innovate and remain competitive in the long term. Among survey respondents, 49% are simultaneously improving workforce productivity and accelerating the adoption of new technologies, with another 33% solely focused on productivity gains. Also, 74% are evolving their human resource model to meet the future requirements of work.

For example, Bolivia has the world’s largest deposits of lithium, according to the Economist Intelligence Unit. Lithium is a key component required for better battery technologies. However, the deposits have barely been commercialised because the resurfacing operations require both investments in tech experience, as well as negotiations with the local communities, who’d been protecting against mining operations.

Despite the commitment to cost optimisation, 36% still plan to invest more in human capital this year and 21% plan to address weaknesses in talent acquisition. Also, 43% plan to increase headcount in certain areas to improve organisational productivity vs 30% globally. Another 35% are doing so in combination with headcount reduction to save costs.

Company leaders must also help shape the workforce of tomorrow — essential to drive innovation and growth. Present-day graduates lack critical workplace skills, which constrains their entry into the workforce and eventually builds up social unrest. The International Labour Organisation suggests youth unemployment rates in the region are high: 21.6% in 2021 among people, aged 15-24 years. Moreover, women's participation in the workforce is 24% lower than male participation.

A large percentage of local people are engaged in informal employment, which represented between 40% and 80% of the jobs generated in 2022. Informal workers are 3 to 4 times more likely to be poor — a factor, which creates ongoing tensions in local societies.

With better ESG practices in place, LATAM leaders could engage a wider proportion of the local citizens in the new initiatives, defusing the ongoing tensions. Moreover, a stronger domestic customer base with higher purchasing power would be critical for meeting future growth objectives.

New leadership style for a better tomorrow

In this most challenging business environment, business leaders need to cultivate new behaviours and corporate narratives, especially given that leaders are continuously in the spotlight in today’s interconnected.

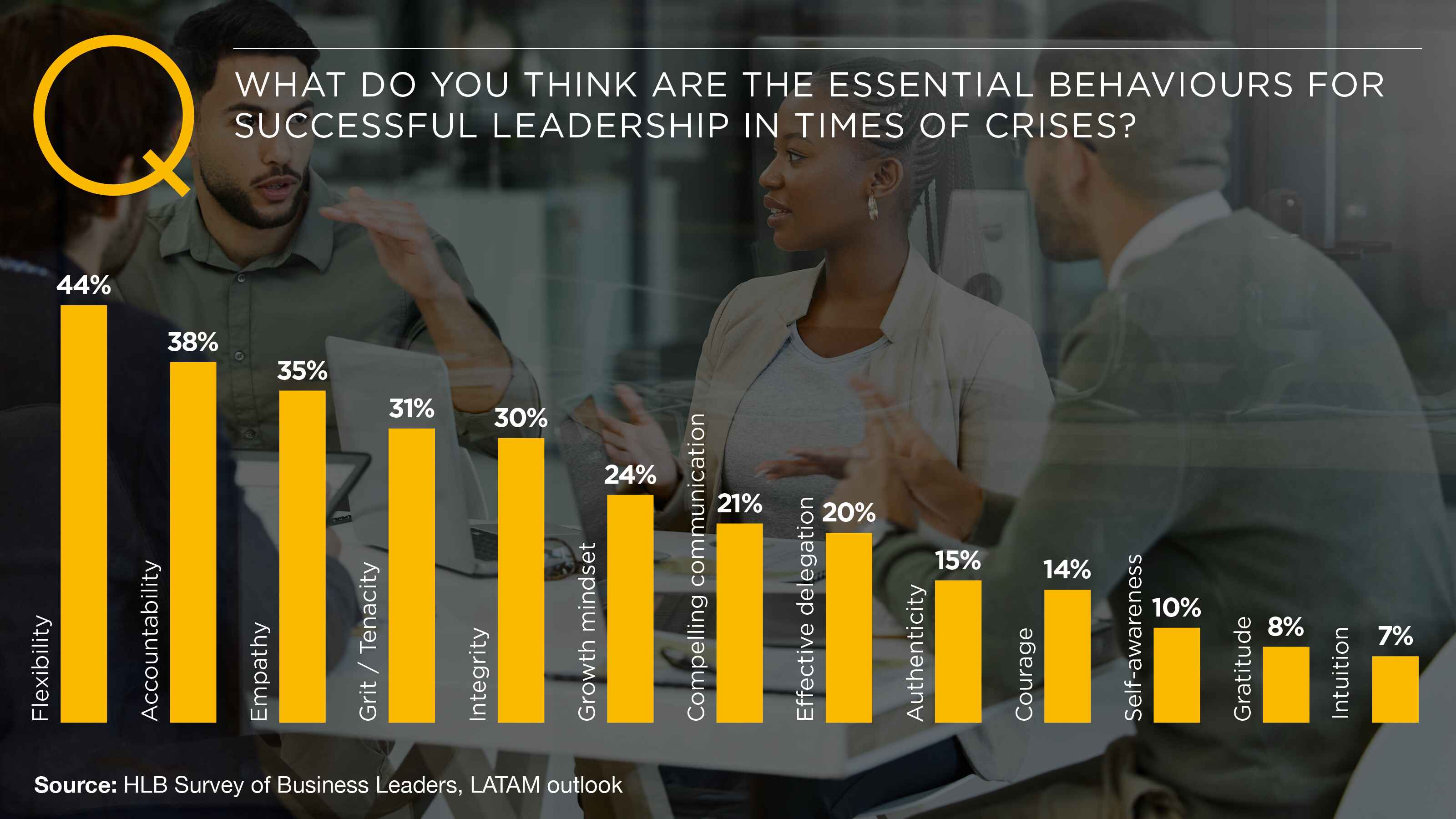

We asked business leaders in our survey to tell us what they think are the essential behaviours for successful leadership in times of crises. Leaders in LATAM selected “flexibility”, “accountability” and “empathy” as the top leadership attributes they feel will see them through stormy times.

Although leaders in the region are heavily focused on transformation, innovation and growth, their responses indicate a significant degree of flexibility around how they were targeting growth in 2023.

Over half of the respondents in LATAM are focusing on building operational efficiency whilst at the same time investing to innovate and grow. Nearly half are simultaneously focusing on accelerating the adoption of new technologies as well as improving workforce productivity. 46% are focusing on both improving business performance and ESG impacts and 43% are focusing on both short-term and long-term priorities (albeit a larger group is looking towards the longer-term in isolation). “Avoid immediacy in things, especially in more difficult times,” — a leader in the retail industry recommends.

In a rapidly-developing region, great leaders have to be tenacious and creative. They need to stay atop the emerging trends and evolving market conditions. “Be attentive to what customers appreciate most about the goods and services offered in order to make the necessary changes in a timely manner according to variations in people's preferences”, recommends a CFO in the automotive sector. These responses provide good evidence for a remarkable desire for flexibility — the top essential leadership attribute in challenging times.

There is also plenty of evidence to show that business leaders in LATAM are actively focused on measuring the accountability of their strategies, 61% have a good understanding of what will be required under new ESG reporting requirements and 63% are rethinking their ESG responsibilities.

As mentioned earlier, business leaders indicate that they are ahead of their peers on the ESG maturity curve. Almost three-quarters of respondents are purpose-led or trying to meet wider stakeholder expectations.

Given the frequent social instability, leaders must also exercise good judgement when it comes to the societies they’re operating within. ESG has become an important metric for deciding on investments, which companies seeking strategic alliances should keep in mind.

Leaders are rethinking their approach to ESG. A leader in the energy sector explained that they are becoming “more focused on corporate governance standards. The Matrix will now have a group focused on ESG in general, encompassing the 3 pillars.” Another COO mentioned how they “work towards the sustainable development agenda through educational activities. Our organization's mission is to contribute solutions for global regeneration.”

Leaders in the region are also working to foster greater empathy, the third most critical leadership behaviour in challenging times. In particular, our respondents emphasised the importance of “working honestly”, “working with passion”, and “being a good team player”, while also “remaining flexible and focused”, “having the willingness to grow” and the “aptitude for seeking innovation”.

An agricultural sector CHRO says leaders must “fully understand the dynamics of the job place and the employees working for you so that the decision-making process can be well thought out and all feel like being on a team”. When it comes to workforce development, a CEO in the tech sector recommends other leaders to “understand the employee needs, to be able to accompany them in this stage with more economic and social oscillations”.

Investments in better diversity, equity and inclusivity (DEI) programs, employee upskilling, training, and reskilling programs will also aid LATAM leaders to cultivate a stronger community impact thereby supporting domestic markets and minimising impacts of potential social and political instability on their operations. Investments in better diversity, equity& inclusivity (DEI) programs, employee upskilling, training, and reskilling programs will also aid LATAM leaders to cultivate a stronger community impact thereby supporting domestic markets and minimising impacts of potential social and political instability on their operations.

Business leaders in Latin America face worrisome societal and environmental risks. Given the level of disruption in the region, it is not a surprise that executives are balancing the need to survive the perfect storm, whilst at the same time preparing their organisations to prosper in the longer term.

Regional outlooks

Learn more about our research