Foreign direct investment trends and opportunities in the Caribbean

By Marcelo Fonseca, Global FDI Leader

The Caribbean is a diverse region with robust economic potential and growth opportunities. It consists of small island economies with Gross National Income (GNI) per capita that ranges from US$800 to over US$30,000. These countries are major players in a wide range of global industries. Some of these economies rely on commodity exports, while others depend heavily on tourism. According to the World Bank, the region's countries are split into the following distinctive groups, according to their main source of export earnings: Services Dependent, Light Manufacturing Dependent, Agriculture and Food Dependent and Natural Resources Dependent.

- Services dependent: Antigua and Barbuda; The Bahamas; Barbados; Dominica; Grenada; Jamaica; St. Kitts and Nevis; Dominican Republic; Haiti

- Light manufacturing dependent: Dominican Republic; Haiti

- Agriculture and food dependent: Guyana; Belize

- Natural resources dependent: Suriname; Trinidad and Tobago

The region's main natural resources include petroleum, fish, and natural gas, while the key industries are tourism, sugar, light manufacturing, and component assembly for export.

Tourism accounted for 13.9% of the Caribbean's GDP in 2019 and 15.2% of total employment. This is the region with the highest contribution from tourism globally, but for some countries, the role of tourism is much higher than for others. For example, for the Eastern Caribbean States and the Bahamas, Belize and Jamaica, tourism and travel make up more than 25% of GDP.

The pandemic greatly affected the region's countries, although to a varying degree due to their high dependence on travel and tourism, which collapsed because of border closures and other restrictions imposed to curb the spread of the virus. With tourism coming to a standstill and main markets in advanced economies dipping into recession, the region's economic activity is greatly affected by the pandemic due to dependence on travel and tourism, likely with a likely sharp and protracted economic contraction. It is estimated that it will take years before Cross-border tourism returns to levels where it was before. Also, the significant drop in oil prices negatively impacts commodity exporters in the region through a loss in exports and fiscal revenues. Finally, Caribbean countries face longer-term challenges, including the adverse impacts of climate change, natural hazards and extreme weather events.

The principal exports are sugar and molasses, rum, other foods and beverages, chemicals, electrical components, and clothing.

Although the tourism sector plays a significant role in economic activity, investments are diversified across major Caribbean economies, with inflows of capital from all over the world.

Overview, demographics, macroeconomic indicators and business regulations for selected countries

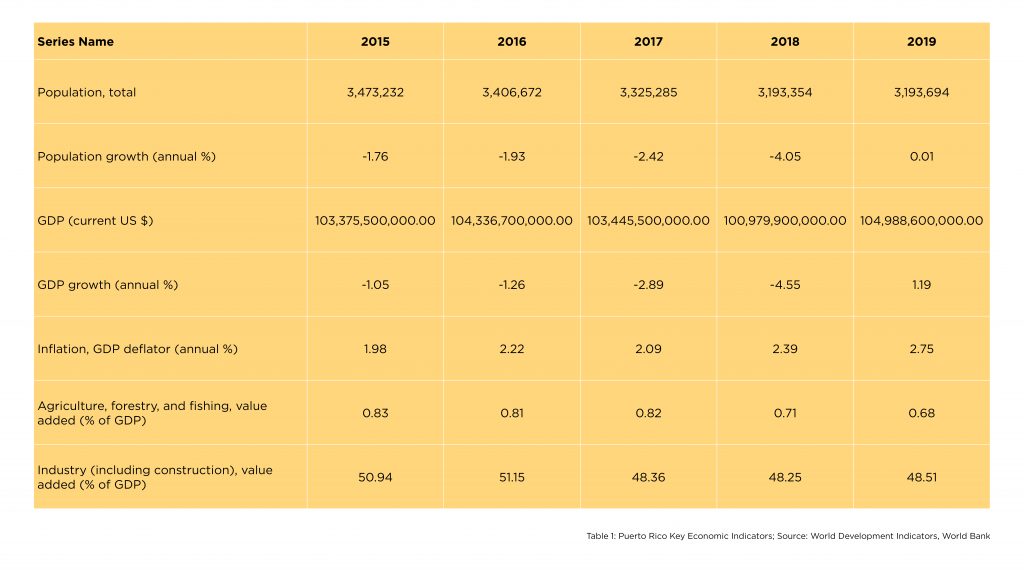

Puerto Rico:

Puerto Rico has very limited natural resources, with arable land being one of the country's most critical natural resources. However, despite its importance, only 6% of the island's total area is considered arable. Puerto Rican agriculture includes sugar cane, coffee, pineapple, plantains, animal products and chickens.

Despite having a substantial agricultural potential, agriculture accounts for just 0.7% of Puerto Rico's GDP and employs only 2.1% of the labour force. Puerto Rico experiences several challenges that hinder the country's full utilisation of its agricultural potential, mainly due to the low number of people willing to work in the agricultural sector. As a result, the island satisfies about 85% of its food needs from imports, even though most of its land is fertile.

Industry accounts for 50% of GDP and employs 19% of the labour force. The Puerto Rican industrial production includes drugs, electronic devices, petrochemicals, processed foods, clothing and textiles. The country's economic profile has shifted from industrial production relying on labour — such as the food industry, tobacco, copper and textiles —to a capital-based service industry. Services now represent the second-largest sector in the Puerto Rican economy, contributing 41.5% to the GDP and employing the overwhelming majority (79%) of the labour force. The service industry's main sectors include tourism, finance, insurance, trade, real estate, transportation and utilities.

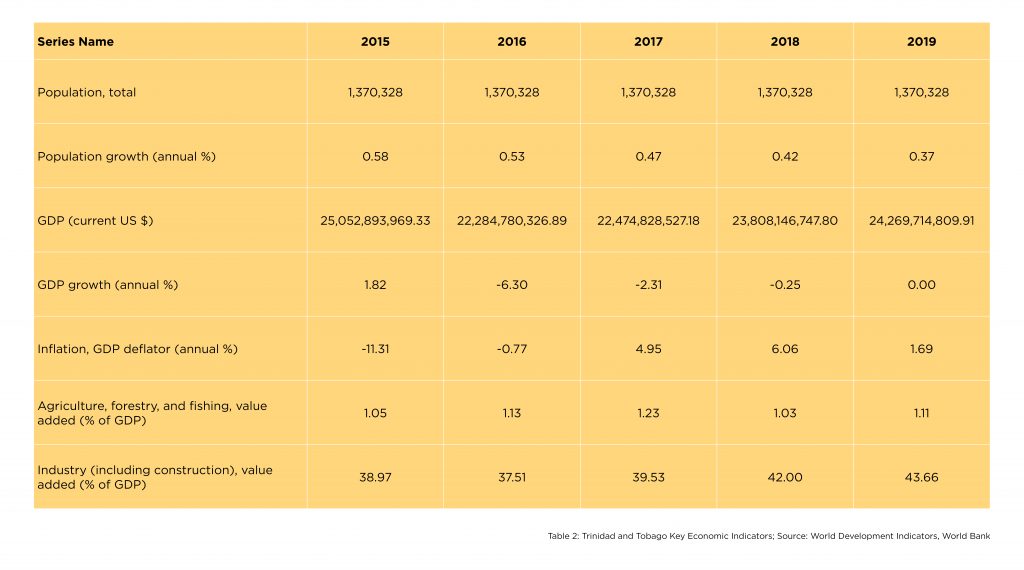

Trinidad and Tobago:

Trinidad and Tobago is one of the wealthiest countries in the Caribbean. The most important sector of the economy is oil and gas production which accounts for around 40% of GDP while employing only 5% of the labour force. Trinidad and Tobago is also a major producer of ammonia and methanol. In recent years, services like finance and tourism have been rapidly expanding as the government is trying to diversify the economy. Yet, corruption, poor infrastructure and drug-related crime are the major obstacles to harnessing the full growth potential in the private sector and tourism.

Jamaica:

Traditionally, the backbone of the Jamaican economy has been the tourist industry and the mining sector. Jamaica is the world's third-largest producer of bauxite and alumina and the sector is the country's second-largest foreign exchange earner, second only to tourism. Other sectors that are essential contributors to the economy include agriculture and manufacturing. In the case of the former, sugar and bananas were the crops produced for export, though these have been on the decline despite recent improvements in the sugar industry. The garment industry was a traditional main export contributor but has declined because of increased competition from lower-cost exporters. The country's main trading partner is the USA and while it's economic diversification is to be commended, its lack of investment weakens its competitivity. In 2013 Jamaica launched a plan to stabilize its economy with positive results in reducing its public deficits and unemployment rate.

Cayman Islands:

Tourism and the well-developed offshore financial sector is the mainstay of the Cayman Islands' economy. As a tax haven — a jurisdiction with no taxes on personal or corporate income, profits or property — Cayman Islands also have liberal regulations which allow foreigners to purchase real estate and no exchange controls. The services sector accounts for 87% of GDP with financial and insurance services accounting for one third. With no other significant economic activity, the country virtually imports all that they need. There is a large trade deficit, but this is easily financed by revenue from tourism and the financial sector.

Dominican Republic:

The Dominican Republic is one of the fastest-growing economies of the Caribbean. Traditionally, the agricultural sector was the mainstay of the economy. However, the decline in this sector has led tourism, communication and construction to be the major contributors to the economy. As such, the government has been investing in tourism-related projects in hopes of revitalising the economy. Recently, the mining and manufacturing sectors have also started improving their performance. The country needs to improve its competitiveness while struggle with bureaucracy costs and access to credit.

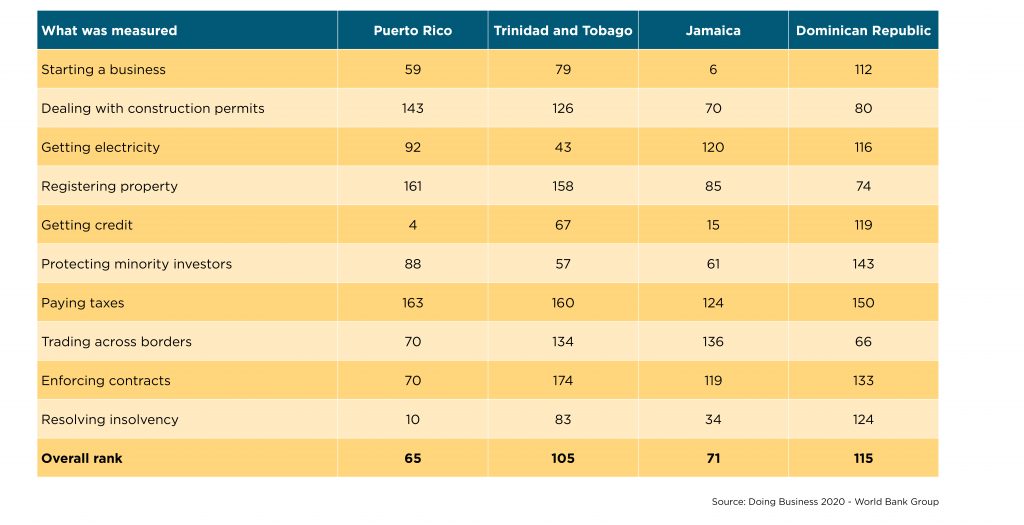

Business regulations:

The table below comprises information from the report “Doing Business” issued by The World Bank. As stated on this report:

“Doing Business presents quantitative indicators on business regulations and the protection of property rights that can be compared across 190 economies— from Afghanistan to Zimbabwe—and over time”.

Figures below represent each item measured and its rank among 190 countries. An overall rank is given to each country in accordance to the World Bank method.

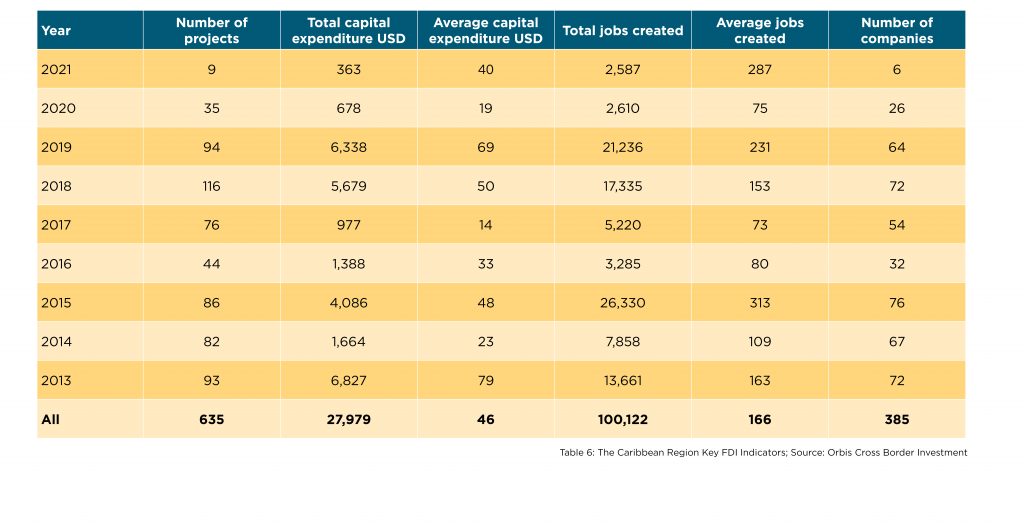

The Caribbean Region Key FDI Indicators

Since 2013, the Caribbean region has made 635 FDI-related projects. Over the period, the number of projects varied between the individual years significantly—from 35 in 2020 to 116 in 2016. The current number of FDI-related projects is only nine. During the same period, the region recorded nearly $28 billion in FDI-related capital expenditure. This indicator also exhibited significant variability over the years, ranging from a record-high $6.82 billion in 2013 to $678 billion in 2020. The two metrics — the number of FDI-related projects and total capital expenditure — when taken together, mean that the average capital expenditure per project is $46 million, with individual values per year ranging from $19 million (2020) to $79 million (2013). During that period, the FDI-related projects created over 100 thousand jobs with an average value of 166 new jobs per project.