Plotting a course for growth amidst disruption

Africa and the Middle East - HLB Survey of Business Leaders 2023Africa and the Middle East have seen a steady recovery after the initial shocks of the pandemic. Yet, the economy in the region faces new waves of disruption: from accelerating inflation to higher food and energy costs and exchange rate volatility.

Leaders in the region have a split sentiment about the prospects for global growth. Respondents in the Middle East and North Africa (MENA) are slightly more optimistic: 48% expect an increase in global growth this year, whereas 36% think the rate of global growth will decline. In the Sub-Saharan region, the outlook is inverted: only 37% believe in an increase in growth, whereas 49% expect a decline in the coming year.

There’s some room for cautious optimism. The African development bank group predicts that Sub-Saharan Africa will experience a real GDP growth of around 4% in 2023 and 2024, outperforming the rest of the world. However, global and regional risks are impacting growth prospects, namely growing energy prices, worsening global financial conditions, and the mounting costs of servicing domestic debt priced in US dollars.

MENA countries entered 2023 stronger as the local economies benefited from the increased oil revenues. The World Bank, however, expects regional GDP growth to slow down to 3% in 2023 (from 5.8% in 2022). Inflation rates in the region also continue to accelerate. Among HLB survey respondents, “inflation” is the top concern for MENA-based leaders, whereas leaders in Sub-Saharan Africa are the most preoccupied with exchange rate volatility.

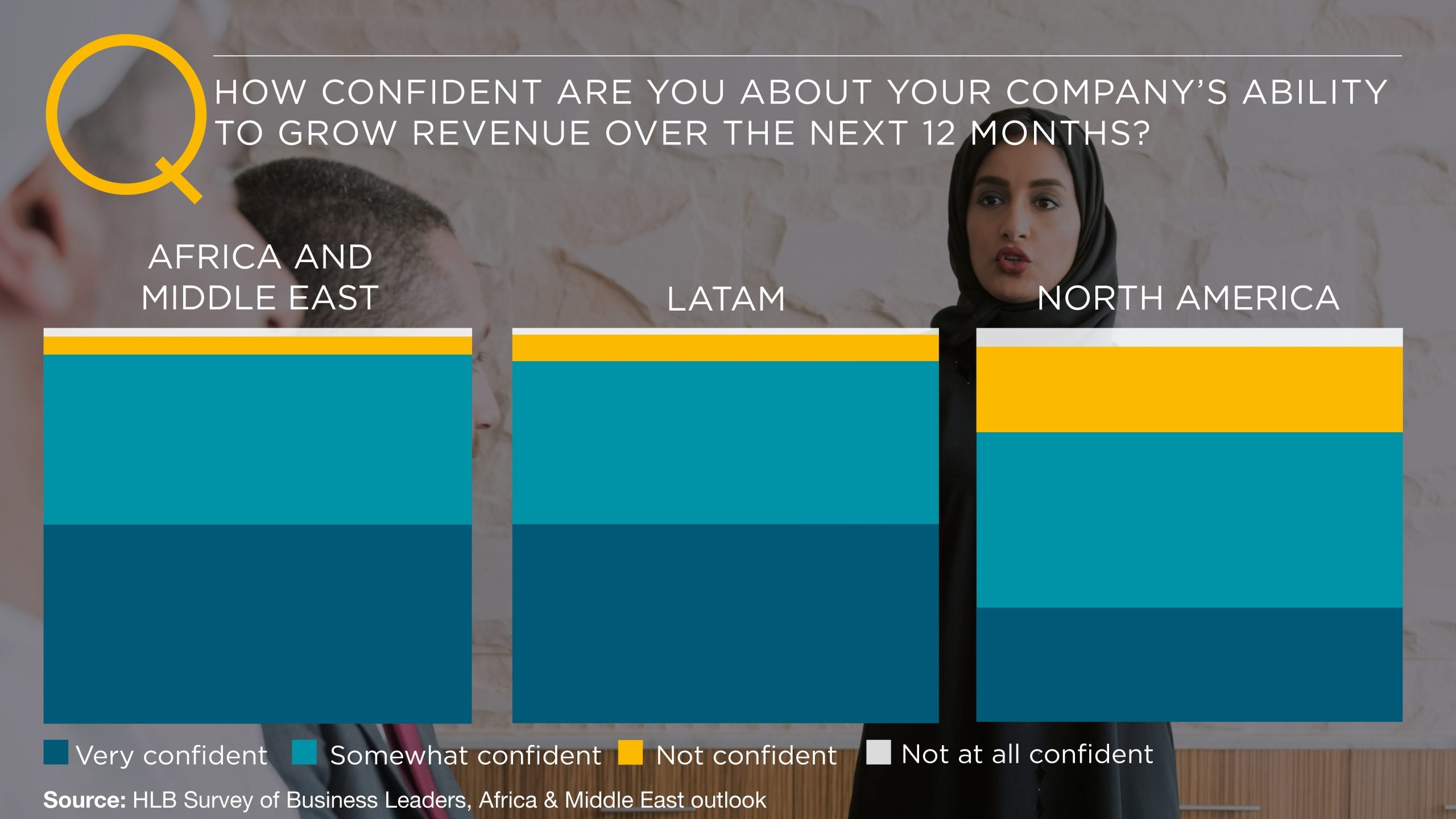

A complex macroeconomic environment doesn’t faze business leaders in the Middle East and Africa. On the contrary, they are certain of their abilities to weather the storm. 94% believe in their company’s ability to grow revenue this year. This is the highest level of business confidence among our global survey cohort, surpassing that of LATAM leaders (at 93%) and substantially more than leaders in Europe (68%), North America (79%), and the APAC (71%) regions.

Navigating risk volatility

Although regional growth is on the rise, business leaders are still facing a challenging year ahead. To succeed, leaders need to “be resilient and adapt to any challenges or obstacles you may face in an environment that is becoming more difficult by the day”, according to a CEO in the tech sector.

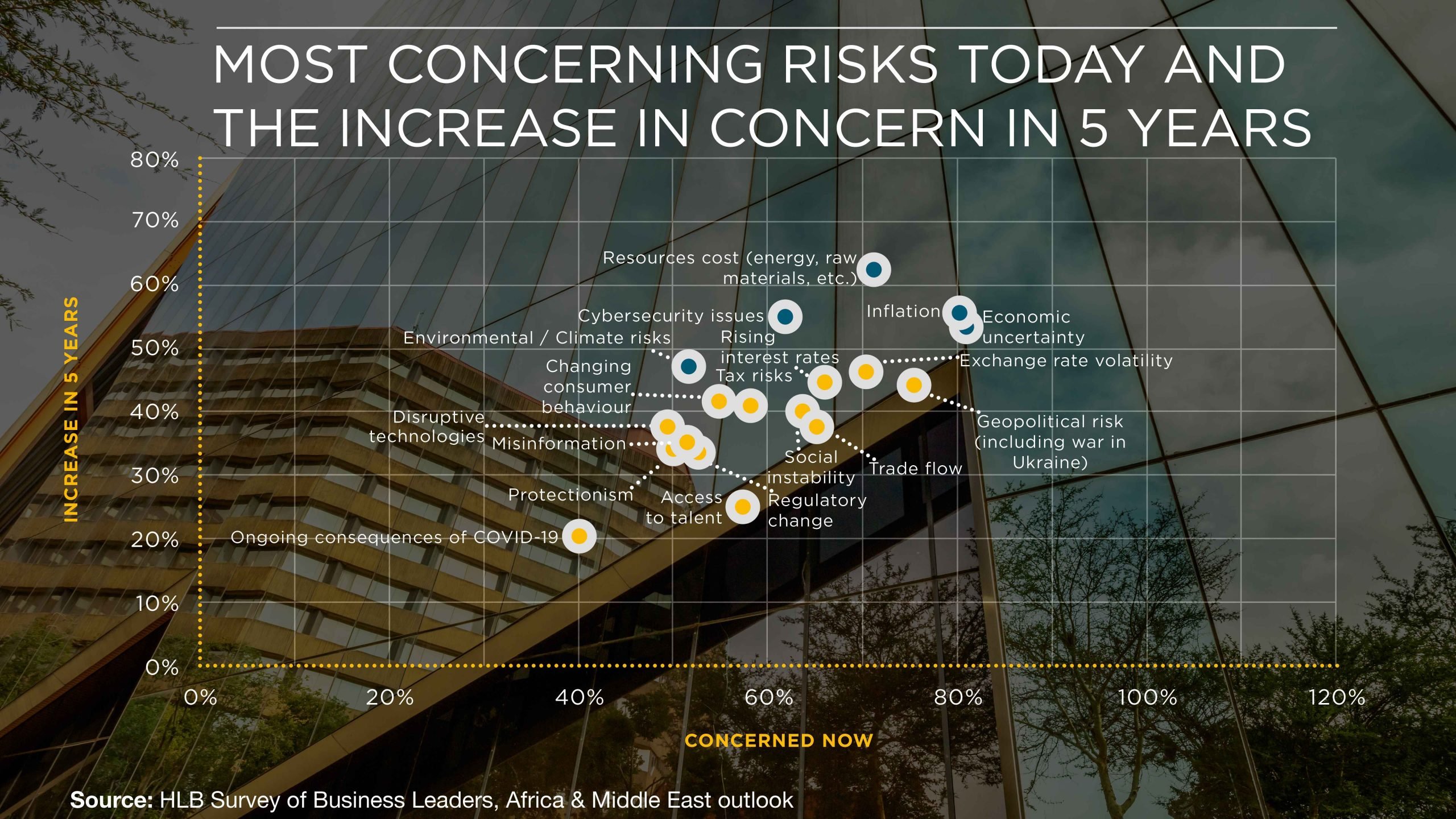

Business leaders based in Africa and the Middle East face a slightly different risk radar to their global peers. Other headwinds are stalling the recovery. The majority of leaders (71%) are concerned about exchange rate volatility (of whom, 36% are very concerned), economic uncertainty (81%), and accelerating inflation (80%). All three factors are interconnected and reinforce one another.

Since the start of the pandemic, most regional currencies have weakened. The latest fiscal actions by the international governments continue to negatively impact the stability of local currencies. MENA and Sub-Saharan Africa are dependent on the United States dollar (USD) as it remains the main currency for trade and debt servicing. The USD volatility and the US Federal Reserve's aggressive interest rates policies have accelerated the devaluation of the region's currencies.

Egypt’s pound weakened by more than 13% to a new low below 32 cents to a dollar at the beginning of 2023, leading to soaring prices on imported foods and other goods. The worst-hit currency on the continent is the Ghanaian cedi, which has lost 40% of its value against the dollar over the nine months of 2022.

Prices for imported energy resources (petrol and diesel) have increased by 113.5% and 83.2% respectively, leading to a spike in transportation costs and a rollover effect on the price of basic commodities, the African Business reports. The South African rand has gone from peak to trough as the (rand-US dollar) exchange rate swung 37% over the past year.

The International Monetary Fund (IMF) expects ongoing pressure on local currencies due to persistent global inflation and tighter monetary policies, issued by the global fiscal authorities. MENA and sub-Saharan African leaders should brace themselves for further disruptions from these macroeconomic imbalances.

Among survey respondents, 62% expect that “resource costs” will become a bigger concern in five years' time. Although, this is more of a concern for Sub-Saharan African leaders of whom 74% expect further cost acceleration vs 56% in the MENA region. In MENA, 56% expect both inflation and resource costs to become the most prominent risks in 5 years' time.

Sub-Saharan African leaders are more concerned with the consequences of “inflation” and “exchange rate volatility”, which have already been evident in the region for an extended period. In contrast, MENA leaders have benefited from greater currency stability, but are now concerned about the future economic developments in the region.

Overall, over half of the leaders expect “economic uncertainty” to remain a lingering concern and 48% also flagged “exchange rate volatility” as an ongoing risk to growth. The future risk radar will be largely shaped by the policies governments adopt to address soaring energy and food costs, as well as actions to stabilise the performance of local currencies.

Cyber risks appear to be a new concern facing businesses in the region, with 53% of leaders expecting cyber risks to increase in 5 years. Just under half are also concerned by future climate/environmental risks. Rightly so, as most countries in Africa and the Middle East are highly vulnerable to climate change impacts. Present-day exposure to extremely high temperatures, limited groundwater and rainfall already undermines the region’s local food security. High population growth and tight geographic concentration can also make climate impacts more acute in the next decade if water reserves get further depleted and arable land areas diminish.

Renewed leadership in challenging times

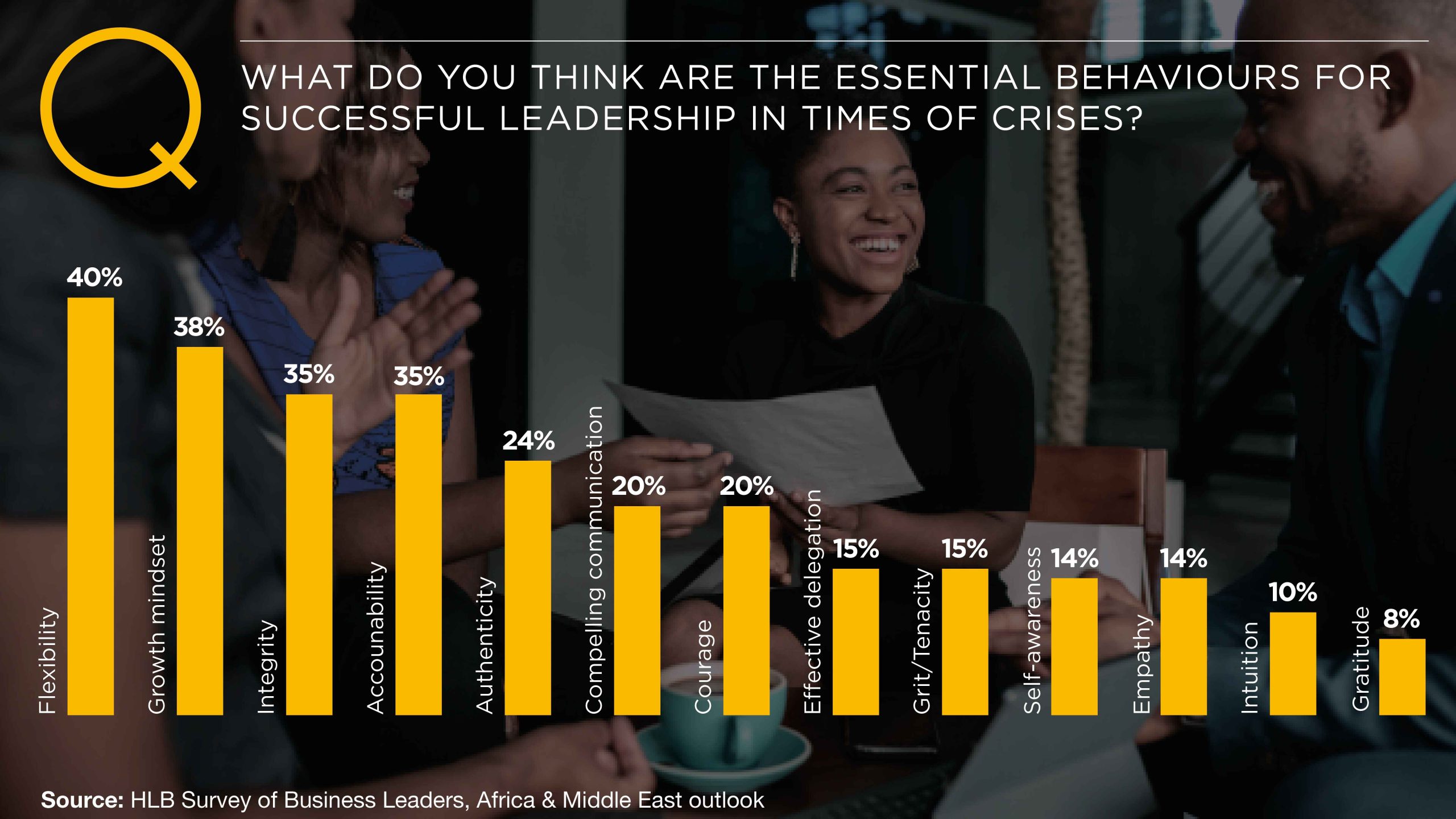

To navigate today’s crises and business disruptions to come, business leaders will need to build resilience around how they manage their businesses, supply chains and their people. This year, we asked leaders what they deem as essential behaviours for successful leadership in times of crises. Business leaders based in A&ME selected the following leadership attributes:

- Flexibility (40%)

- Growth mindset (38%)

- Integrity and accountability (35%)

Their present and planned actions further demonstrate how this type of new leadership can be executed in practice.

Leading with flexibility

Africa and Middle East leaders are facing a number of juxtaposing priorities. On one hand, they need to stabilise their companies’ performance after the first waves of disruption (the pandemic and then the war in Ukraine). On the other, they need to also position their businesses for future growth, which is picking up pace. As a local CEO said: “There are a lot of ways and there can be many chances”. Leaders must harness leadership flexibility in order to be ready to make the most of changing trends and emerging opportunities when and as they arise.

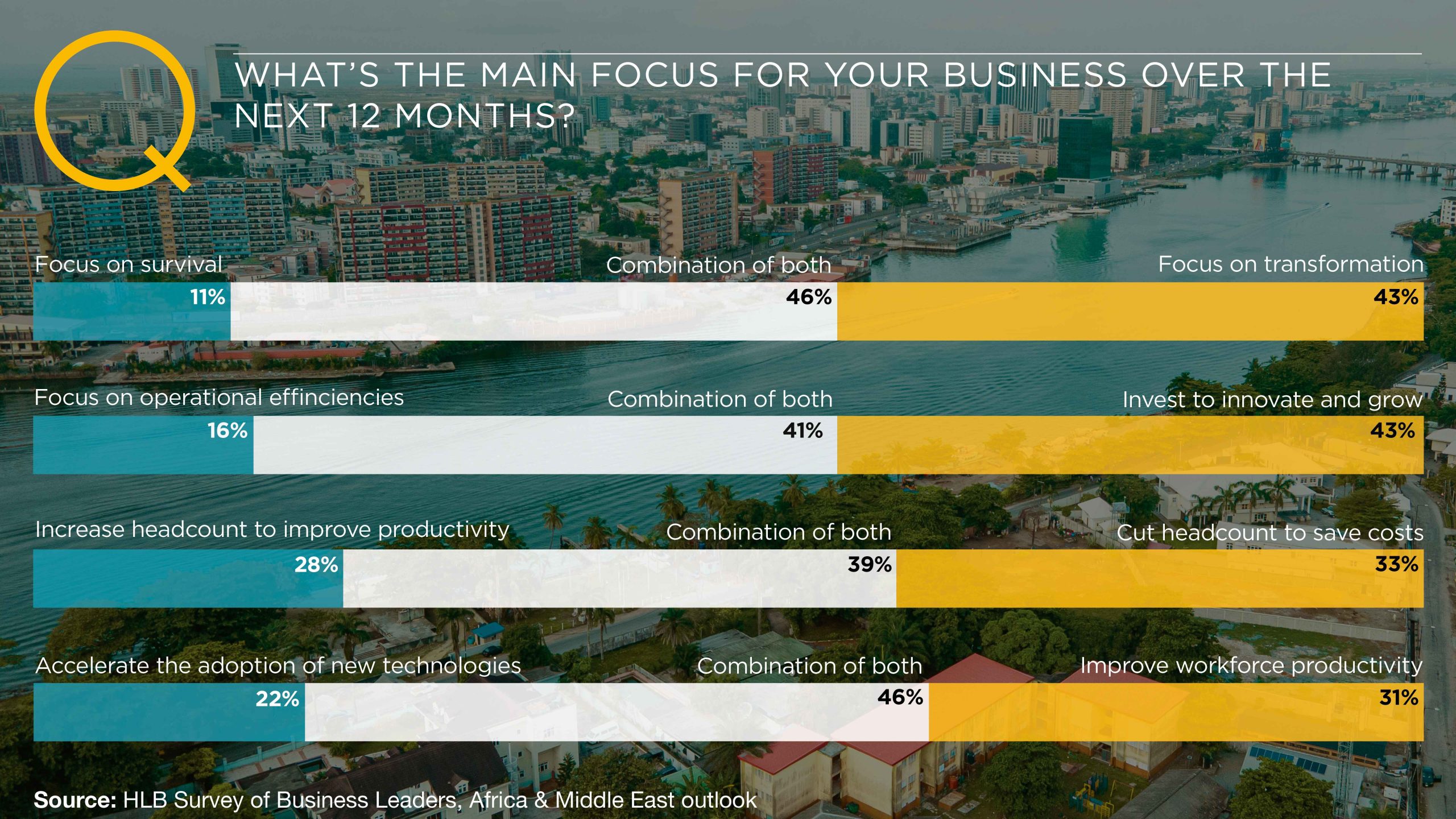

Business leaders in the region are showing much capacity to flex their strategies to suit the situation. Although 86% are focused on longer-term priorities to thrive and 45% do so in combination with short-term, survival-critical actions.

Flexibility is essential to cope with multi-dimensional risks: economic, regulatory, and climate-related. About two-thirds of African states have increased their domestic policy interest rates in 2022 to stave off inflation and decrease pressure on exchange rates, according to the Economist Intelligence Unit.

To effectively service the soaring public debt, due to increased international borrowing costs, most states will have to further raise domestic interest rates (and likely taxes). The changes in fiscal policies could leave unprepared businesses with depleted cash flows. Among respondents, 34% flagged “risk management” as a weakness worth addressing this year, which would be essential to navigating the extended risk radar.

72% plan to cut headcount to save on costs, however, this includes 39% who, at the same time, are planning to increase headcount in order to improve productivity. Unlike global peers, African and Middle East leaders aren’t seeing as many constraints in talent: Only 17% see “talent acquisition” as a weakness, worth addressing in the next 12 months vs 35% globally.

Several African countries have government-level talent mobility agreements. Mauritius is leading the implementation of an intra-Africa Talent Mobility Partnership (TMP) Program in 12 pilot countries, with funding from the World Bank Development Grant Facility (DGF). The TMP program establishes a “Schengen” type of agreement, which facilitates the cross-border mobility of talent in the region.

Ample access to a competent, multilingual, and cost-effective labour force has accelerated the growth of outsourcing services in the region. New job clusters in business process outsourcing (BPO), information technology outsourcing (ITO), and KPO (knowledge process outsourcing) have emerged, and now drive an influx of foreign capital.

The BPO market in the Gulf Cooperation Council GCC (GCC) countries is expected to reach $2 billion by 2025 if it maintains a present-day 10% year-on-year growth rate. However, local BPO providers will need to mature their operational models to meet the evolving demands of international partners.

Our survey respondents recognise the need for continuous transformation. 77% plan to simultaneously improve workforce productivity and accelerate the adoption of new technologies. Moreover, 54% are evolving their human resource model to meet the requirements of the future of work.

Leading with a growth mindset

Having a growth mindset is the second-highest-rated essential behaviour for successful leadership in times of crisis, according to business leaders in the ME & Africa. Whereas other regions are more focused on cost containment and strategy reviews, A&ME leaders are looking to innovate and grow.

We asked leaders to select their preferred focus between investing to innovate and operational improvement. 84% are investing to innovate and grow, however, more than half of these respondents are aiming to do so in conjunction with a combined focus on operational efficiencies. The theme of “doing more with fewer resources” has been a continuous one since the pandemic began. With somewhat depleted cash reserves and constantly changing macroeconomic conditions, businesses need to simultaneously “work to grow, satisfy customers, and work with high efficiency” as a COO in manufacturing says.

Improving operational efficiencies is the top response when we asked business leaders about priority actions to grow and remain profitable over the next 12 months in order, (selected by 60%). However, the majority of leaders in Africa and the Middle East are also looking to launch new products or services over the next 12 months. Over half are also committed to adopting new technologies to support their growth plans.

“In the age of technology that we are living in now, it is no longer enough to keep on making the same products. People who can imagine new approaches and new ideas will win”, a CFO in the educator sector pointed out.

Innovative thinking and tactical usage of technology have become the core differentiators of Africa's booming startup ecosystem. Four African countries — Nigeria, Egypt, South Africa, and Kenya — have emerged as startup powerhouses, dubbed Africa's new “big four”.

Despite the turbulent global economic conditions, African startups secured a record-breaking $3.3 billion in funding in 2022, which is a 55% increase compared to 2021. The FinTech sector drew the most investor attention, followed by e-commerce, RetailTech, e-health, logistics, energy, AgriTech, and transport.

The MENA startup ecosystem has been evolving as well. Forbes reports that MENA’s 50 most-funded startups raised around $3.2 billion in 2022, up 6.7% from the year before. Similar to Sub-Saharan Africa, FinTech companies secured the most funding, followed by e-commerce, mobility, and logistics firms. The United Arab Emirates (UAE) was the most represented country on the list, followed by the Kingdom of Saudi Arabia (KSA), and Egypt.

On a country level, governments are also issuing ambitious digital development plans, which create a more competitive business development landscape and aim to attract more FDI. The UAE 2025 Digital Government Strategy is bringing the country into a new era of cross-sectoral, data-driven collaborations across the private and public sectors.

Dubai aims to double the size of the city economy, foreign trade and investment by 2033. Sheikh Mohammed announced a target of $8,7 trillion, delivered by 100 new projects, ranging from sustainable manufacturing to scale-up programs for local businesses and new trade routes with African, LATAM, and APAC partners.

KSA leadership has also presented a Vision 2030 project, aimed at diversifying the country’s economy, increasing employment, and improving the level of FDI. The country is attempting wide cultural and economic transformations, aimed at improving inclusivity, tourism, economic development, and sustainability.

Ambition and the potential for rapid economic growth are definitely present. Yet, business leaders will need to transform their bold vision into a reality. The ability to execute precise, lean, and rapid digital-led transformation will differentiate future leaders from laggers.

“While the young generation already embraces innovations and new technologies, time remains the crucial limiting factor. Those who make more effective use of their time will succeed”, said a CEO in the business services sector. To prepare for the new growth cycle, 32% plan to address weaknesses in digital capabilities in the next 12 months, while 29% want to improve their “innovation” abilities.

Prolonged economic uncertainty can further exacerbate ongoing concerns with social instability, which already worries 63% of leaders, and regulatory change. The ease and speed of doing business can be also majorly affected by the lacking infrastructure and climate related risk factors. As of 2020, 98% of energy production in MENA originated from fossil fuels. The growing population and greater reliance on technology not only exponentially accelerate the demand for electricity and other energy resources, but also increase the environmental toll of producing them.

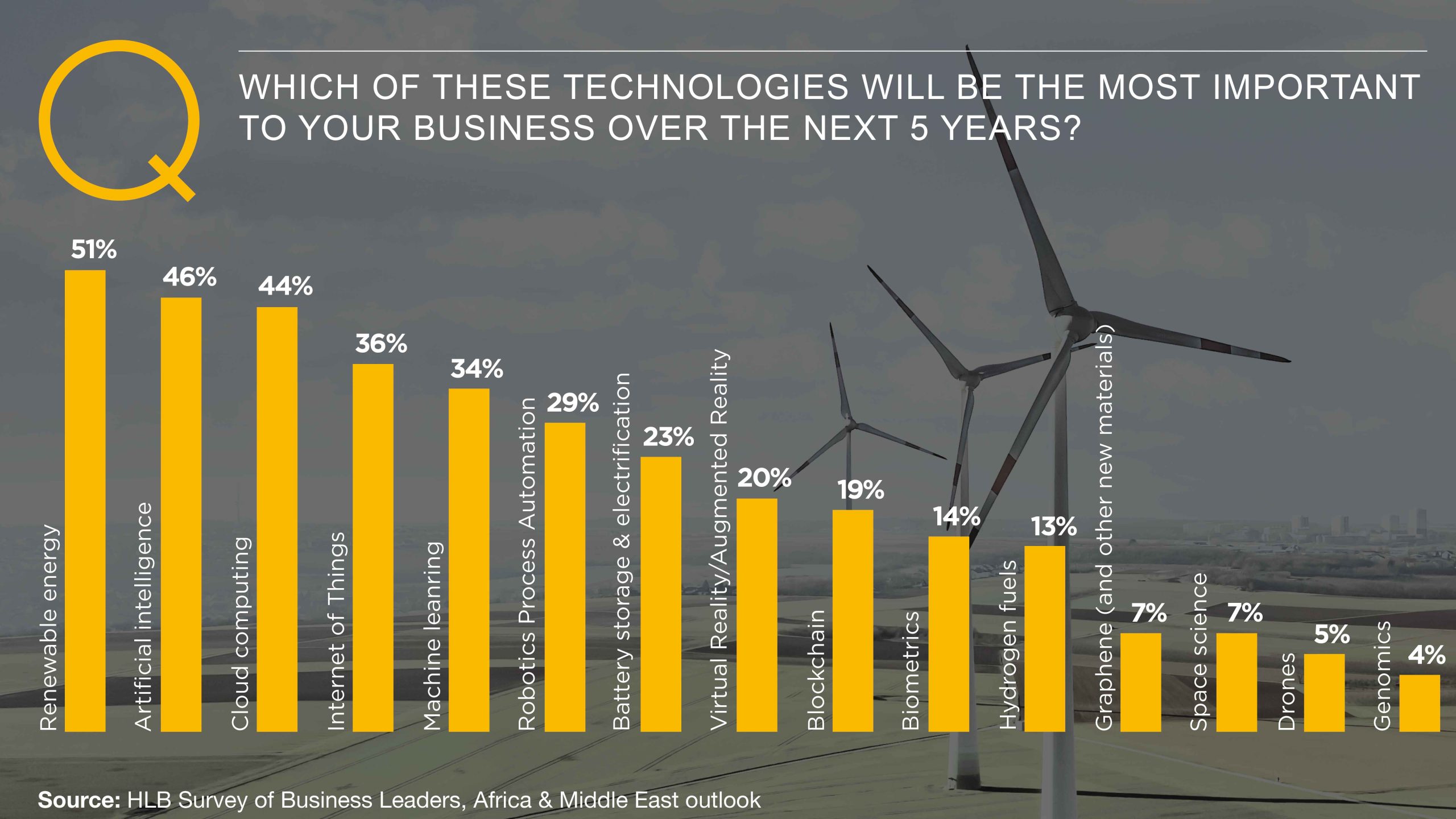

It appears that local leaders already recognise the importance of shifting to more sustainable resource production and usage. 51% deem “renewable energy” as the most important technology for their business in the next 5 years versus 40% globally and only 28% in North America. The other two most important technologies are “artificial intelligence” and “cloud computing”, which are consistent with global responses.

Investment in digital capabilities could undeniably help African & ME companies internationalise and become competitive on a global scale, which many already are. Yet, investment in sustainability-related projects is even more crucial for securing long-term stability and prosperity in the region.

The desire to transform is evident with 89% of business leaders focusing on transformation including 43% for whom transformation is their sole focus over the next 12 months (as opposed to survival). At the same time, 86% are looking to focus on longer-term priorities, over half of these doing so in combination with short-term, survival-critical priorities. Only 14% are focused solely on survival.

Leading with Integrity and accountability

Integrity and accountability are joint third most highly rated essential behaviour for successful leadership in times of crises, according to business Leaders in Africa & ME. Integrity is a critical trait, especially in difficult times, as it helps build trust and credibility with stakeholders.

Although local leaders are more inclined to focus on improving business performance (for 38% it’s the sole focus area), another 39% do so together with improving environmental, social, and governance (ESG) impacts.

“From continuously improving operational efficiency and the environmental performance of our facilities, to pursuing low carbon energy solutions, and strategically investing for growth, we view sustainable practices as the best way to ensure our business remains viable for the long-term” commented a CFO in the education sector.

Indeed, greater commitment to sustainable operations could help ensure long-term competitiveness. Most of Africa's income is derived from exporting petroleum products, coal, metals, and minerals, making it the most commodity-dependent region. As global investors and corporations face public pressure to address ESG risks in global supply chains, local businesses in these areas will face more scrutiny. The spotlight has been on the region since it hosted COP27 in Sharm el Sheikh, Egypt.

Apart from reducing the rising impacts of climate change, the green energy transition can also create new economic opportunities. The World Bank suggests that most countries can substantially benefit from the green energy transition. Egypt can generate over two million new direct and indirect job opportunities in the next 30 years by meeting renewable energy targets. Over the next five years, the UAE could capture 25% of the low-carbon hydrogen market, valued at more than $400 billion a year. As Europe seeks alternative energy sources, MENA and Sub-Saharan Africa partners could become the region's new reliable suppliers.

Business opinions on ESG reporting, however, are somewhat divided. 39% of the leaders in our survey say that they’re only ensuring check-box compliance with regulations, while another 39% are trying to meet wider stakeholder expectations. However, an impressive 18% of leaders in the region indicate that they are entirely purpose-led in terms of their journey towards meeting ESG goals.

Leaders who are seeking wider inclusion of ESG in operations or identify as purpose-led companies are working to “[seek] access to new technologies to reduce our carbon footprint and use of International Guidelines to make effective ESG Reporting”, “increase support for the energy transition”, “go beyond compliance to proactive incorporation of environment consideration in business processes”, “implement tactics to optimise water consumption in production and watering plants, and installing solar panels to help reduce the carbon print of our factories”.

“We have elevated our sustainability efforts across the company. That’s because we believe the consideration of ESG factors results in more constructive engagement and better-informed investment decisions – helping our clients achieve their financial objectives” says a CPO in Government & Public Sector.

However, only 52% of business leaders in the region admit to having a good understanding of what will be required under new ESG reporting requirements. Several Middle Eastern stock exchanges have already developed voluntary guidelines for reporting ESG performance such as the Bahrain Bourse and Tadawul in Saudi Arabia. Investors, such as bondholders, countries not traditionally involved in bilateral lending, and commercial banks, have made efforts to integrate sustainability into their investment strategies for the region, according to Fitch Ratings.

Although ESG reporting isn’t mandatory yet in most countries, business leaders are already providing extra disclosures to reassure local and international stakeholders, as well as the general public.

A leader in the manufacturing sector sums it up: “Clarity creates visibility. Visibility creates accountability. Accountability creates results.”

With regard to one of the social aspects of ESG, over half of the leaders in the Africa & ME said they were evolving their human resource model to meet the requirements for the future of work. To cultivate a fit-for-the-future workforce, Africa & ME leaders will have to address several areas.

Women's inclusion in the workforce remains low in MENA. In Jordan, the female labour force participation rate is below 15%, while that of men is about 60%. In Lebanon, only 23% of women are in the workforce and in KSA – 22%, according to the World Bank. Additionally, youth unemployment rates of 25% are disturbing.

A financial services leader says: “We will do our best to be transparent by regularly publishing to the public quantitative and qualitative information about our institution’s conditions, as well as reporting to our regulators. Our strategy focuses on expanding in the medium term, thus, creating more job opportunities for the talented workforce”.

An engaged, competent workforce will be crucial for achieving a future competitive advantage and ambitious growth targets of business optimisation, tech adoption, and new product development.

Sailing smoothly through choppy waters

By deploying the leadership behaviours most valued in a crisis — flexibility, growth mindset, and integrity and accountability — business leaders in the Middle East and Africa can navigate through increasingly challenging risk conditions and find a path to growth.

Flexibility enables leaders to adapt to changing circumstances and respond to unexpected challenges, while a growth mindset encourages continuous learning and improvement, leading to innovative solutions. Moreover, demonstrating integrity and accountability builds trust with stakeholders, leading to increased support and collaboration.

By deploying these leadership behaviours, executives in the Middle East and Africa can not only prepare for ongoing risks and disruption but also support a culture of innovation, and resilience, to support sustained growth for their organisations.

HLB Global welcomes further conversations on the report's findings. Please get in touch with our local experts at HLB to discuss how you can chart a course for growth in challenging times.

Regional outlooks

Learn more about our research