Egypt

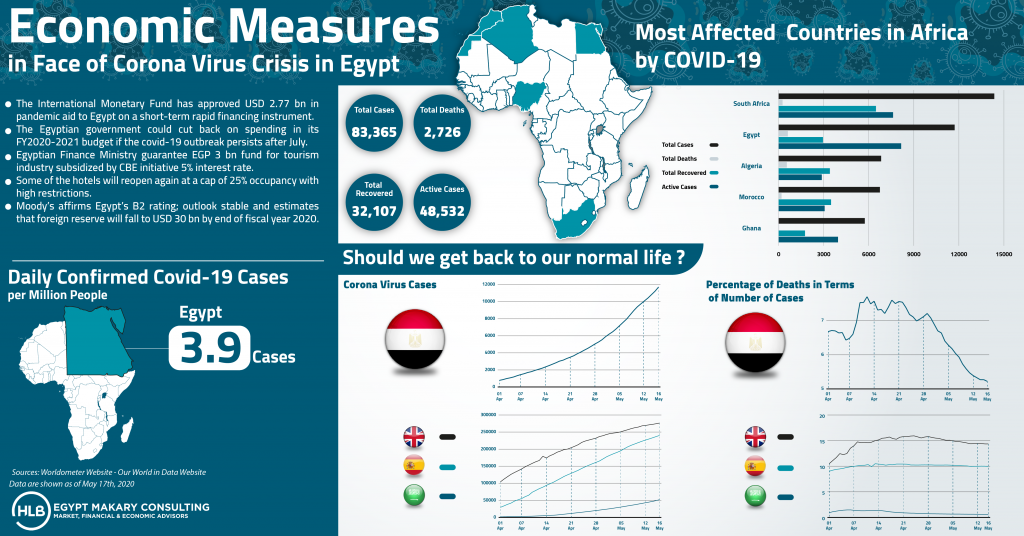

Economic measures in face of corona virus crisisThe government of Egypt took quick and responsive immediate actions, in response to the global Covid-19 outbreak, since the appearance of the first confirmed case in mid Mach 2020. The situation in Egypt is relatively contained, till date, as compared to other countries, however the curve is still on the rise (refer to info graph below).

Total confirmed cases are reported by Ministry of Heath to be 12,229 and number of deaths totaled 630 individuals in May 17th, 2020. The confirmed cases doubled since beginning of May, when the Ministry of Health reported 6,193 confirmed cases and 415 deaths on May 2nd, 2020.

The situation is closely and continuously monitored by a special committee chaired by the Prime Minister and all decisions are announced to the public. All decisions have a definite time duration, and are revised periodically, depending on the escalation of the issues.

The government is currently considering relaxing the lock down procedures, consistent with the global trend worldwide, in order to avoid prolonged significant economic downturn. In this respect, the government issued a reopening guidelines and protocols pamphlet to provide safety instructions for individuals, corporate and government institutions during the Covid-19 prevalence.

The immediate actions taken are broadly classified into:

- Health sector initiatives;

- Liquidity measures;

- Fiscal actions;

- Debt restructuring actions.

Health sector initiatives

These include efforts of social distancing and funds to support the health situation as follows;

- Temporary closure of all schools, universities, airports, rituals, restaurants and coffee shops (allowing for restricted delivery service), government institutions, with the exception of the ones providing direct health and food services/products, and all sort of public meetings, workshops or exhibitions during the period from mid-March till April 23rd, 2020, subject to extension depending on the situation. The only exceptions are groceries, supermarkets, pharmacies and hospitals/health centers. Starting from April 23rg, 2020, and until further notice, the schools, universities, airports and religious places shall remain closed, however, other retail activities, including shopping malls, are allowed to re-open with fixed closing hours (5 pm);

- Lately hotels were allowed to re-open, provided they abide by strict hygiene measures stipulated by the government, at 25% occupancy rate in May and 50% occupancy rate in June. However, all group activities, events, weddings and night club/entertainment activities are banned, till further notice;

- Impose nationwide night-time curfew and stop all types of mass transportation during the curfew period, from 7pm to 6 am until end of March, 2020, which was later relaxed to be from 8pm to 6 am until April 23rd, 2020, then further relaxed from 9 pm to 6 am from April 23rd till further notice;

- Measures to limit the number of government employees going to work and encouraging through a media campaign and speeches by Prime Minister and President for virtual remote working, social distancing and staying home. Currently, this is being replaced by measures and campaign to live safely with the virus;

- Provide direct monetary support amounting to EGP 187.6 million to the Ministry of Health, directed to both medical supplies and preventive measures, and bonuses to workers in the health care system. The government announced that 2% of GDP shall be directed to the health sector;

- Prepare medical sites nationwide to anticipate the escalation of Covid-19 patients;

- Double the contribution percentage to public expenditure on health in the national budget.

Liquidity measures

These refer to measures to increase liquidity in the market at both national and sector level, as follows;

- A USD 2.7 billion loan was requested and granted by the IMF, as an emergency support;

- Reduce the overnight deposit and lending rate and the discount rate by 3% at once in order to create finance accessibility and reduce the cost of borrowing;

- Provide support to the most affected sectors, to include;

- Allocate EGP 50 billion loan fund to be directed to the tourism sector at subsidized interest rate for new and expansion projects;

- Provide credit facility to pay employees’ salaries in the tourism sector to be repaid on a period of 2 years, with grace period of 6 months;

- Exclude necessity goods from need to raise 100% cash cover for importation;

- Allocate EGP 20 billion fund to support the capital market;

- Subsidize the electricity and natural gas tariffs for the industrial sector;

- Reduce lending interest rate from 10% to 8% for the industrial and tourism sectors;

- Allow cash subsidies for daily earning workers amounting to EGP 500 per person;

- Facilitate access to credit facilities for working capital finance and removal of some credit restrictions;

- Payment of EGP 1 billion of export subsidy arrears and facilitate export procedures.

Fiscal actions

These include tax exemptions and public expenditure at both national and sectoral levels;

- Proceed with mega infrastructural projects;

- Provide 3 month tax relief for Real Estate taxes for tourism and industrial sectors;

- Allow 3 months installments to settle income tax for corporate companies for all affected sectors, during the period April to June, 2020, instead of one-time settlement in April;

- Allow delay in submission for individual tax reports to April 9th from March 31st;

- Increase the exemption tax limit for employees from EGP 8,000 to EGP 15,000;

- Raise the annual raise of public sector and state employees by 7% and 12%, respectively and for pensions by 14%;

- Tax reduction for the capital market to include removal of stamp duties, postponing capital gains to January 2022, and exemption for foreign investors and reductions of dividends taxes from 10% to 5%.

Debt restructuring actions

- Delay of settling credit dues for individual banking loans (retail) for a period of 6 months and increase the monthly amount of loan repayment from 30% to 50% of monthly income;

- Removal ATM withdrawal limits for credit cards and principal dues for credit cards for a period of 6 months;

- Initiation of debt relief for amounts at risk of default on debt with amounts less than one million EGP;

- Allow grace period for mortgage lenders, factoring and leasing companies for a period of 6 months;

- Write-off EGP 17 billion from 226 distressed firms.